If you’ve ever opened your brokerage app, stared at the red numbers, and wondered, “Am I taking too much risk?” you’re not alone. Learning how to use ChatGPT to analyze risk tolerance and build a diversified portfolio can turn that anxiety into a clear, repeatable process you can actually follow.

In a 2025–2026 environment of shifting interest rates, lingering inflation, and persistent market volatility, understanding your risk tolerance and building a diversified portfolio are more important than ever. ChatGPT won’t replace a human advisor, but used correctly, it can be a powerful planning assistant that helps you structure your thinking and avoid emotional decisions.

Core Concept/Overview of How to Use ChatGPT to Analyze Risk Tolerance and Build a Diversified Portfolio

Key Component 1: What Risk Tolerance Really Means

Before you learn how to use ChatGPT to analyze risk tolerance and build a diversified portfolio, you need a proper definition.

The U.S. SEC’s investor education site defines risk tolerance as an investor’s ability and willingness to lose some or all of an investment in exchange for greater potential returns. investor.gov+1

That breaks into two dimensions:

- Ability to take risk

- Your income stability

- Size of your emergency fund

- Other assets and liabilities

- Time horizon for your goals

- Willingness to take risk

- How you feel when markets drop

- Whether you’ve sold in panic before

- How comfortable you are with volatility

When you use ChatGPT to analyze risk tolerance and build a diversified portfolio, the goal is to get a clear written description of both your ability and your willingness—not just a vague label like “aggressive” or “conservative.”

Key Component 2: Why Diversification Is Non-Negotiable

The second half of how to use ChatGPT to analyze risk tolerance and build a diversified portfolio is, of course, the portfolio itself.

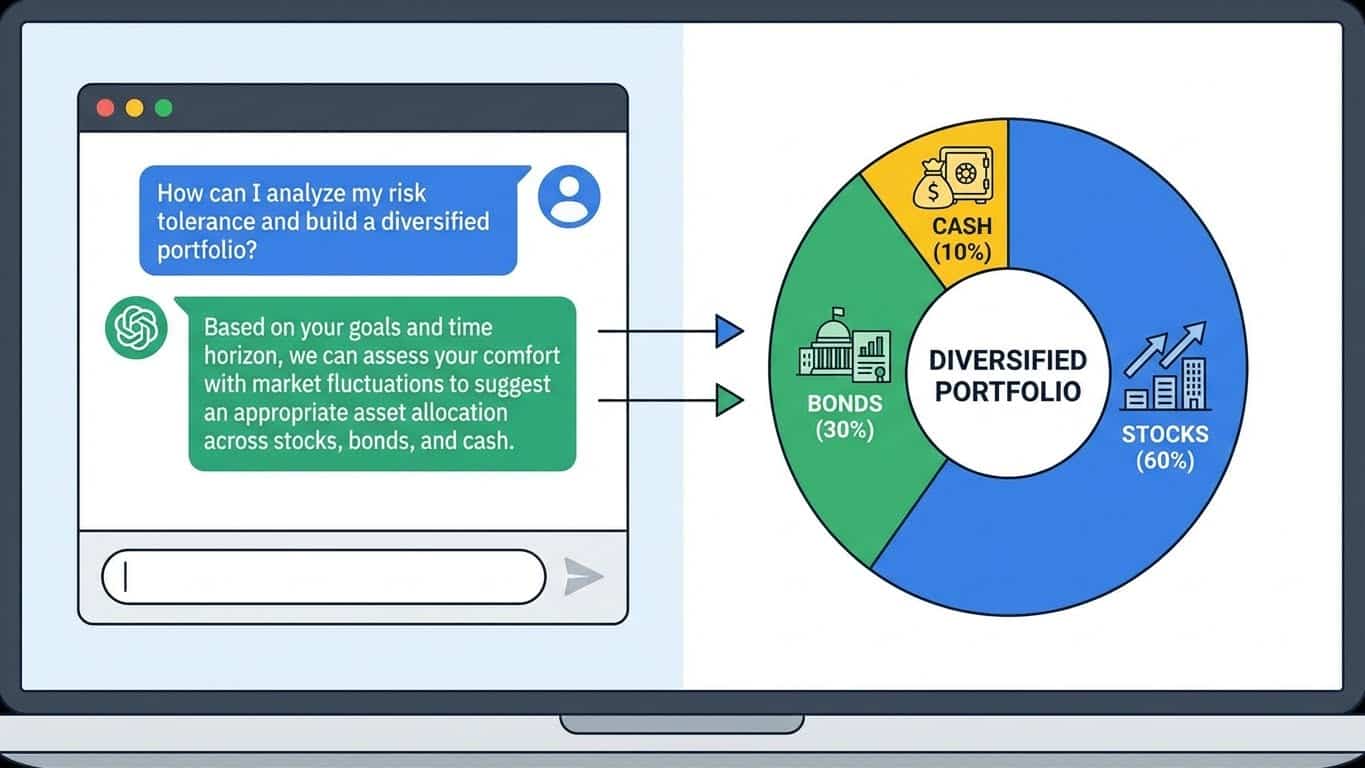

Diversification is simply spreading your money across different assets so one mistake or shock doesn’t destroy your entire plan. Investor education resources consistently highlight diversification as one of the most important ways to reduce risk—“don’t put all your eggs in one basket.” investor.gov+2investor.gov+2

In practice, diversification usually means combining:

- Domestic and international stocks

- Different types of bonds

- Some cash or cash-like assets for stability

In a world of unpredictable macro shocks, this matters. A diversified portfolio won’t remove risk, but it can narrow the range of outcomes and make it easier to stay invested through rough periods.

Practical Strategies / Framework

Now let’s turn theory into a practical, step-by-step framework for how to use ChatGPT to analyze risk tolerance and build a diversified portfolio.

Strategy Type 1:Using ChatGPT to Analyze Your Risk Tolerance

You’ll get the best results if you give ChatGPT structured information instead of vague questions.

Step-by-Step Prompt for Risk Tolerance

- Collect your key data Write down:

- Age and main goal (e.g., retirement in 25 years)

- Income stability and amount

- Size of your emergency fund (in months of expenses)

- Debt amounts and interest rates

- Past reaction to market drops (sold, held, bought more)

- Feed ChatGPT a clear snapshot Example prompt: “You are my investing risk-profiling assistant.

Here is my situation:- Age: 34

- Main goal: Retirement in 30 years

- Net monthly income: $4,500, stable job

- Emergency fund: 4 months of expenses

- Debt: $2,500 credit card at 20%, $10,000 student loan at 4%

- In past market drops, I felt stressed but did not sell my investments.

Explain in terms of ability and willingness to take risk, and list 3 follow-up questions to refine the assessment.” - Answer follow-up questions honestly ChatGPT will likely ask things like:

- “How would you feel if your portfolio dropped 20% in a year?”

- “How important is capital preservation vs. growth?”

- “When do you expect to need this money?”

- Create a risk-tolerance summary paragraph Finally, ask: “Summarize my risk tolerance in 4–5 sentences I can reuse later when we talk about my portfolio.”

This “risk profile paragraph” becomes the anchor you’ll reuse every time you use ChatGPT to analyze risk tolerance and build a diversified portfolio in future chats.

Strategy Type 2: Using ChatGPT to Build a Diversified Portfolio Blueprint

Once you’ve clarified your risk tolerance, you can ask ChatGPT to help sketch a high-level allocation. This is educational, not personal investment advice, but it’s a powerful starting point.

Step-by-Step Prompt for a Diversified Portfolio

- Share your risk profile and constraints Example: “Here is my risk tolerance summary: [paste].

I want a long-term portfolio for retirement (25+ years).

I prefer low-cost index funds or ETFs and no more than 5–6 total holdings.” - Ask for an example allocation Prompt: “Based on this risk tolerance and time horizon, propose an example diversified portfolio allocation by percentage across:

- Domestic stocks

- International stocks

- Bonds

- Cash or short-term instruments

- Request a simplified version If the output looks too complex, ask: “Simplify this into a 3-fund or 4-fund version while keeping the same overall risk level.”

- Design a review and rebalancing routine SEC guidance emphasizes that asset allocation should be reviewed periodically, including rebalancing back to target weights as markets move. investor.gov+2SEC+2 Ask ChatGPT: “Create a simple annual checklist I can use to review this portfolio and decide whether to rebalance, based on changes in my risk tolerance, time horizon, and market moves.”

By repeating this process once or twice a year, you’re consistently using how to use ChatGPT to analyze risk tolerance and build a diversified portfolio as a living system, not a one-time quiz.

Actionable Prompt Library (Copy/Paste Table)

Here’s a quick prompt library you can save:

| Purpose | Prompt Snippet |

|---|---|

| Analyze risk tolerance | “You are my investing risk-profiling assistant. Here is my age, income, savings, debts, and reactions to past market drops…” |

| Refine risk profile after follow-up questions | “Update your assessment of my risk tolerance and rewrite my 5-sentence risk profile paragraph…” |

| Build sample diversified allocation | “Using my risk profile, propose an example allocation across domestic stocks, international stocks, bonds, and cash, and explain each weight.” |

| Simplify into 3–4 funds | “Simplify that allocation into 3–4 funds while keeping the same overall risk level.” |

| Create annual review checklist | “Design an annual portfolio review checklist and rebalancing rules that align with my risk profile.” |

how to use ChatGPT to track financial goals and cash flow

Examples, Scenarios, or Case Insights

Let’s see how to use ChatGPT to analyze risk tolerance and build a diversified portfolio with numbers. These are simplified scenarios, not personal advice.

Example 1: Moderate Investor with 25-Year Horizon

Profile (summarized by ChatGPT):

- Age: 35

- Stable income, 5-month emergency fund

- Comfortable with some volatility but wants to sleep at night

- Time horizon: 25 years

ChatGPT classifies this as “moderate” risk tolerance.

You might ask:

“Given my moderate risk tolerance and 25-year horizon, suggest an example allocation and show what percentage is in stocks, bonds, and cash.”

ChatGPT could respond with something like:

- 65% stocks (45% domestic, 20% international)

- 30% bonds

- 5% cash / short-term

If your portfolio is $50,000, that means:

- $32,500 in stocks

- $15,000 in bonds

- $2,500 in cash

You can then ask:

“If I contribute $800 per month to this portfolio for 20 years, show rough projections at 4%, 6%, and 8% average annual returns, explaining that actual returns will vary.”

This gives you a sense of potential outcomes and helps you decide if your savings rate and risk level are on track for your goals.

Example 2: Conservative Investor Nearing Retirement

Profile:

- Age: 58

- Wants to retire in ~7 years

- Very uncomfortable with large drawdowns

- Has meaningful savings but wants to preserve capital

ChatGPT might define this risk tolerance as “conservative”.

You could then ask:

“Based on this conservative risk tolerance and 7-year horizon, how would you adjust a portfolio that is currently 80% in stocks and 20% in bonds?”

An example educational answer might be:

- Move toward 40–50% stocks, 40–50% bonds, 10–20% cash

- Focus stock portion on broad, diversified funds

- Use high-quality bonds to dampen volatility

You can then decide whether such a shift feels appropriate, possibly consulting a professional advisor before making big changes.

Common Mistakes and Risks

When applying how to use ChatGPT to analyze risk tolerance and build a diversified portfolio, avoid these traps:

- Sharing overly sensitive data

- Don’t paste full account numbers, ID numbers, or highly personal details. Summaries are enough to get useful guidance.

- Treating ChatGPT like a licensed advisor

- ChatGPT helps you think and organize. It is not a regulated financial advisor. Always view its suggestions as educational starting points.

- Confusing “ability” and “willingness”

- You might emotionally feel aggressive but have little savings and an unstable job—your real capacity for risk is lower.

- Over-engineering your portfolio

- Asking for 15 different funds with tiny slices isn’t better. Simple, diversified allocations are usually easier to manage.

- Never revisiting your risk tolerance

- Life changes—marriage, kids, job changes, approaching retirement—should trigger a fresh look at risk and allocation.

- Ignoring fees and taxes

- A “perfect” allocation on paper can be undermined by high expense ratios, trading costs, or tax inefficiency.

- Overreacting to short-term volatility

- Even with a ChatGPT-built plan, you can still panic-sell if you don’t accept that volatility is normal and inevitable. investor.gov+1

Conclusion – Key Takeaways & Next Steps

At its heart, how to use ChatGPT to analyze risk tolerance and build a diversified portfolio is about making your investing decisions more intentional and less emotional.

You’ve seen how to:

- Turn your financial situation into a clear risk-tolerance profile using structured prompts.

- Translate that profile into example diversified allocations that match your goals and comfort level.

- Build a simple review and rebalancing routine so your portfolio evolves with your life and the broader economic environment.

Your next steps:

- Write down your income, savings, debts, and time horizons for key goals.

- Use the risk-profiling prompt in this article to create your own 5-sentence risk-tolerance paragraph with ChatGPT.

- Ask ChatGPT to draft a sample allocation and an annual review checklist tailored to that profile.

If you consistently apply how to use ChatGPT to analyze risk tolerance and build a diversified portfolio, you’ll make fewer impulsive moves, stick to a coherent strategy, and give yourself a much better chance of reaching your long-term wealth-building goals.

5 Comments