If you’re pricing a home right now, the monthly payment on a $600,000 mortgage can feel like a moving target—especially after a Federal Reserve rate cut. However, a Fed cut doesn’t automatically translate into a lower mortgage rate overnight. Mortgage rates are influenced more by long-term bond yields and mortgage-backed securities markets, so the “new” payment depends on what lenders are offering today.

In this guide, you’ll learn how to calculate payments, how big a difference small rate changes can make, and how to build a simple decision framework for buying, refinancing, or waiting.

Section 1 – Core Concept/Overview: Monthly payment on a $600,000 mortgage

A mortgage payment is usually discussed in two ways:

- Principal & Interest (P&I) — the loan repayment portion calculated from your loan amount, rate, and term.

- Total monthly housing cost (PITI + extras) — P&I plus property taxes, homeowners insurance, and sometimes HOA dues and mortgage insurance.

For clarity, most calculators start with P&I first, because it’s the part most directly affected by interest rates.

Key Component / Sub-Concept 1: How the monthly payment on a $600,000 mortgage is calculated

Mortgage payments use an amortization formula. You don’t need to memorize it, but understanding the inputs makes you a smarter shopper:

- Loan amount (principal): the amount you borrow (e.g., $600,000)

- Interest rate: your annual rate, converted to a monthly rate

- Loan term: commonly 30 years (360 payments) or 15 years (180 payments)

Why this matters after a Fed cut: even a small rate move (like 0.25%) can change your payment meaningfully—especially on a large balance.

Key Component / Sub-Concept 2: Why the Fed cut changes your payment indirectly

The Fed primarily controls short-term interest rates (the federal funds rate). Mortgages, especially 30-year fixed, are priced off longer-term rates and market expectations.

As a result:

- Mortgage rates may fall before the Fed cuts (markets “price it in”).

- Mortgage rates may barely move if investors expect inflation or long-term yields to stay elevated.

- Mortgage rates can even rise after a cut if markets interpret the cut as signaling economic risk or higher inflation expectations.

Section 2 – Practical Strategies / Framework

Instead of guessing where rates go next, use a simple framework: calculate, stress-test, then decide.

H3: Step-by-step or Strategy Type 1 — Calculate your baseline P&I payment

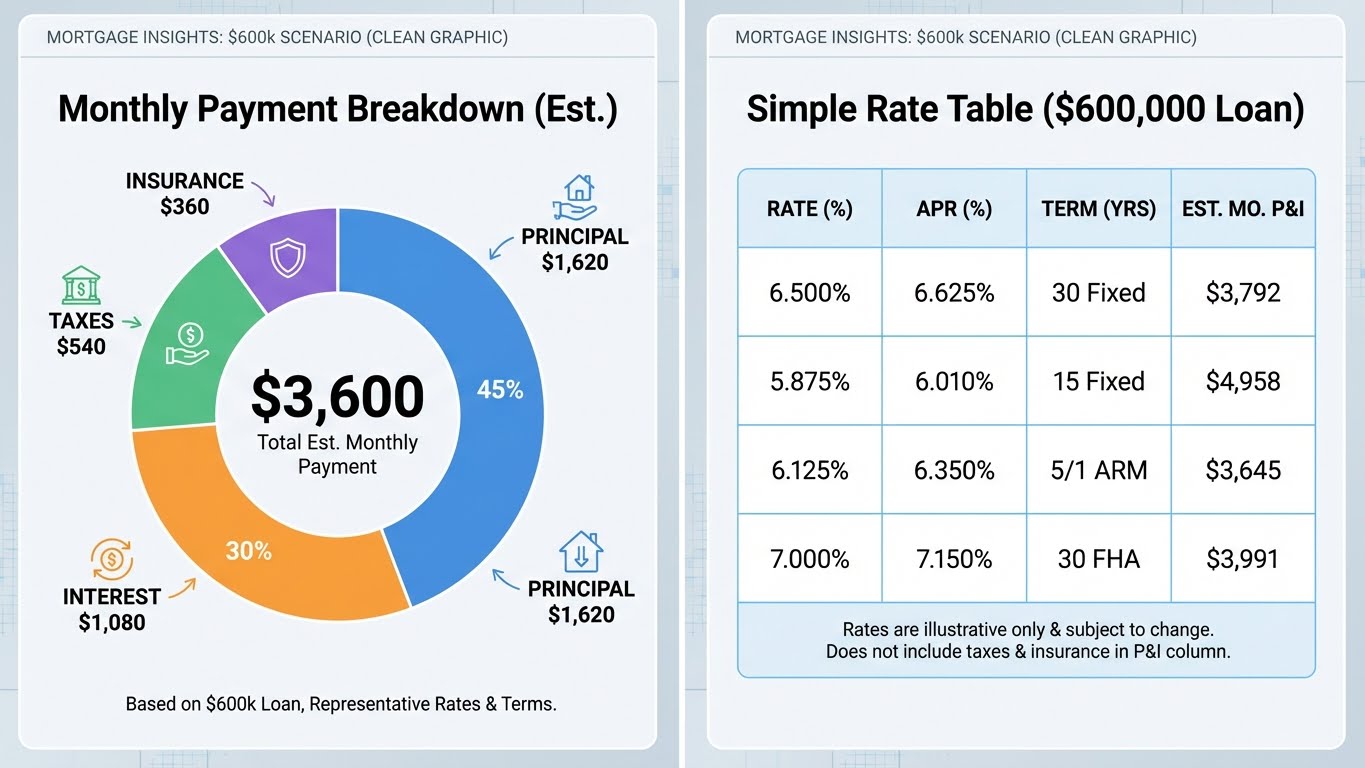

Below is a practical table showing principal & interest only for a $600,000 loan amount at common rate levels.

Assumption: fixed-rate mortgage, fully amortizing, no extra payments.

| Interest rate | 30-year monthly P&I | 15-year monthly P&I |

|---|---|---|

| 5.5% | $3,407 | $4,905 |

| 6.0% | $3,597 | $5,065 |

| 6.5% | $3,792 | $5,227 |

| 7.0% | $3,992 | $5,392 |

| 7.5% | $4,196 | $5,559 |

Quick insight: around these levels, a 0.25% rate change can shift the payment by roughly $90–$120/month on a $600,000 balance, depending on the exact rate and term.

H3: Step-by-step or Strategy Type 2 — Build your “all-in” monthly cost (PITI)

Your lender qualifies you using more than P&I. To estimate your realistic monthly cost, add:

- Property taxes (annual amount ÷ 12)

- Homeowners insurance (annual amount ÷ 12)

- HOA dues (if any)

- Mortgage insurance (if down payment is under ~20%, depending on loan type)

Here’s a quick way to do it:

- Start with your P&I from the table.

- Add taxes (ask the listing, county site, or estimate conservatively).

- Add insurance (get a quote; don’t guess).

- Add HOA and mortgage insurance if applicable.

- Stress-test your budget with a buffer (maintenance + surprises).

Actionable checklist (use this before you lock a rate):

- Confirm whether $600,000 is the loan amount or the home price.

- Compare 30-year fixed vs 15-year fixed vs ARM options.

- Estimate PITI using conservative inputs.

- Stress-test your payment for job risk and higher expenses.

- Lock the rate if the payment fits your plan—not your prediction.

Automating Your Finance Tasks: How to Use ChatGPT to Track Financial Goals and Cash Flow

External authoritative rate source (to plug in today’s average):

https://fred.stlouisfed.org/series/MORTGAGE30US

Section 3 – Examples, Scenarios, or Case Insights

Let’s make this real with a few simple scenarios. These are examples, not quotes from a lender.

Scenario A: You’re borrowing the full $600,000 (30-year fixed)

Assume a 30-year fixed rate at 6.5%.

- Monthly P&I: about $3,792

- Add taxes/insurance/HOA to estimate your true monthly housing cost.

How a small rate drop changes the math:

If your rate moved from 6.5% to 6.25%, your P&I might drop by roughly $100/month. That’s meaningful, but it doesn’t always change affordability as much as people expect—especially once taxes and insurance rise.

Scenario B: $600,000 home price with 20% down (loan ≈ $480,000)

Many buyers confuse home price with loan amount. If the home costs $600,000 and you put 20% down, your loan is about $480,000.

At 6.5% for 30 years, the monthly P&I would be lower than the full $600,000-loan scenario. This is why clarifying the base number matters before you plan.

Takeaway: If you meant “$600,000 home,” not “$600,000 mortgage,” your payment could be substantially different.

Scenario C: Choose 15-year vs 30-year to match goals

A 15-year loan has a higher monthly payment, but it typically offers:

- Less total interest over the life of the loan

- Faster equity build-up

- More flexibility later (because the loan ends sooner)

However, in a 2025–2026 environment where inflation and expenses can be sticky, a high fixed obligation can reduce flexibility.

Rule of thumb framework:

- Choose 15-year if you have stable cash flow and strong reserves.

- Choose 30-year if you value flexibility and want room to invest, save, or handle volatility.

- Consider making extra principal payments on a 30-year if you want optionality.

How to Use ChatGPT to Analyze Risk Tolerance and Build a Diversified Portfolio

Common Mistakes and Risks

Here are common ways buyers miscalculate affordability after a rate cut:

- Assuming a Fed cut = lower mortgage rates immediately. The market may have priced it in already.

- Budgeting only for P&I. Taxes and insurance can be large and may rise over time.

- Ignoring rate lock timing. Waiting for “one more drop” can backfire if rates bounce.

- Forgetting closing costs. Refinancing or buying has upfront costs that change break-even math.

- Not stress-testing cash flow. A payment that barely fits in a “perfect month” is risky.

- Using an ARM without understanding reset risk. ARMs can lower the initial payment, but future adjustments matter.

- Overpaying because the monthly payment “looks okay.” Price still matters; don’t let a rate narrative override valuation.

Conclusion – Key Takeaways & Next Steps

The monthly payment on a $600,000 mortgage depends on your interest rate, loan term, and whether $600,000 is the loan amount or the home price. After the Fed’s December rate cut, the smart move is not to guess where rates go next—it’s to calculate your baseline payment, build your all-in monthly cost, and stress-test your budget.

If you want to take action today, start by plugging a realistic rate into the table above, then add taxes and insurance to get your true number. From there, compare 30-year vs 15-year vs ARM options based on cash flow and flexibility.