The start of 2026 has brought a seismic shift to the American dinner table and the stock market alike. On January 7, 2026, the USDA and HHS unveiled a historic reset of national nutrition policy with the release of the 2025-2030 Dietary Guidelines for Americans. Commonly referred to by the public as the new food pyramid 2026 USA, this update represents a radical departure from decades of nutrition advice. By moving away from ultra-processed staples and re-centering “real food,” these guidelines are not just changing what we eat; they are reshaping the multibillion-dollar food industry and healthcare economy.

For investors and health-conscious consumers, understanding the new food pyramid 2026 USA is essential. The new focus on nutrient density, high-quality proteins, and full-fat dairy is creating massive ripples in consumer staples stocks and agricultural commodities. As the government pivots its procurement for school lunches and federal programs, the financial implications are as significant as the health outcomes. In this guide, we will break down the core components of this nutrition overhaul and provide actionable investment and personal finance strategies to navigate this new era.

Core Concept: The “Real Food” Revolution

The new food pyramid 2026 USA is built on a single, uncompromising principle: Eat Real Food. This “historic reset,” as described by federal health leaders, effectively ends the era of heavy reliance on refined carbohydrates and ultra-processed food (UPF) substitutes. Instead of focusing solely on calorie counting, the 2025-2030 guidelines prioritize the quality and source of those calories to combat chronic diseases like Type 2 diabetes and obesity.

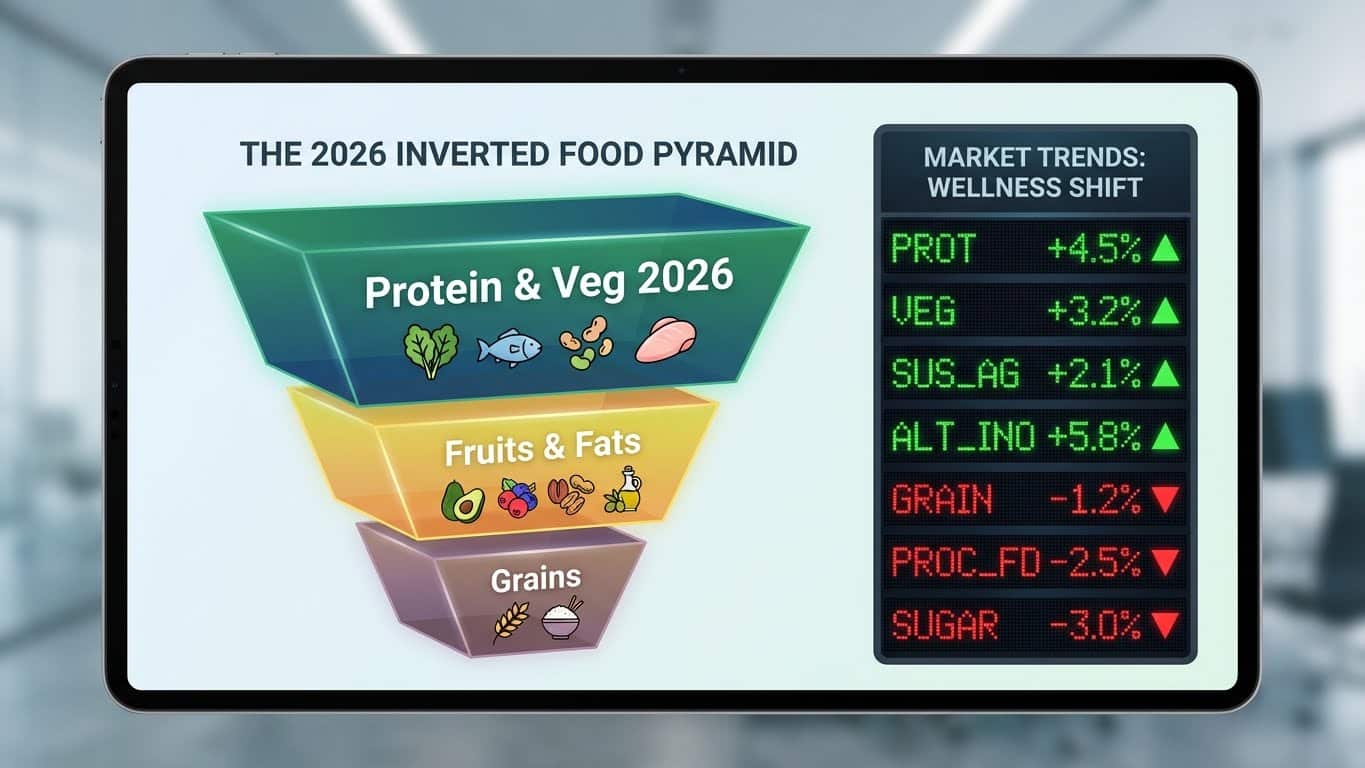

The Inversion of Macronutrients

One of the most striking visual changes in the new food pyramid 2026 USA is its structural “inversion.” For years, grains and cereals formed the broad base of the pyramid. However, the 2026 model elevates high-quality proteins—including red meat, poultry, eggs, and seafood—and nutrient-dense vegetables to the top priority. Whole grains have been moved to a smaller, more supplementary role at the bottom, emphasizing that they should be consumed in their least processed forms.

The Return of Full-Fat Dairy and Healthy Fats

In a stunning reversal of 1990s-era “low-fat” dogma, the new guidelines “end the war on saturated fats” from whole food sources. The 2026 framework recommends full-fat dairy, butter, and beef tallow as viable options for home cooking, provided they are part of a whole-food diet. This shift acknowledges that the processing required to create low-fat versions often involves adding sugars or thickeners that negatively impact metabolic health.

Practical Strategies: Navigating the 2026 Food Economy

Adapting to the new food pyramid 2026 USA requires both a change in your grocery list and a rethink of your investment portfolio. As the $1.5 trillion U.S. food sector reacts to these guidelines, capital is flowing away from traditional “Big Food” manufacturers and toward regenerative agriculture and “clean label” innovators.

Rebalancing Your Consumer Staples Portfolio

The 2026 guidelines take a hard stance against ultra-processed foods, which currently make up a significant portion of many major food conglomerates’ revenue.

- Identify “Clean Label” Leaders: Look for companies that are aggressively simplifying their ingredient lists and removing artificial dyes, preservatives, and added sugars.

- Watch Federal Procurement Shifts: Companies that supply the National School Lunch Program (serving 30 million children) must now align with a strict 10g added sugar limit per meal. Firms that cannot adapt will lose massive government contracts.

- Invest in “Authentic” Plant-Based: The market for “fake meat” imitations is cooling. Instead, investors are finding value in companies producing minimally processed plant proteins like pulses, lentils, and legumes.

Budgeting for Nutrient Density

While “real food” can sometimes carry a higher upfront price tag, the new food pyramid 2026 USA emphasizes long-term financial health through the prevention of chronic disease.

- Buy in Bulk for Proteins: With the higher emphasis on meat and eggs, utilizing local “farm-to-table” shares or wholesale clubs can mitigate the rising costs of animal proteins.

- Prioritize Frozen over Processed: Frozen vegetables and fruits are encouraged as nutrient-dense alternatives to canned goods that may contain added sodium or syrups.

- Leverage Seasonal Produce: Aligning your shopping with the seasonal harvest remains the most cost-effective way to meet the three-serving daily vegetable goal.

| Recommendation Category | New 2026 Guideline | Previous Standard (2020-2025) |

| Added Sugars | Limit to < 10g per meal | < 10% of total daily calories |

| Dairy | Full-fat dairy encouraged | Fat-free or low-fat (1%) only |

| Cooking Fats | Butter, Olive Oil, Beef Tallow | Seed oils (Soybean, Canola) |

| Protein Goal | 1.2–1.6g per kg of body weight | 0.8g per kg of body weight |

| Grains | Secondary to protein/veg | Base of the dietary pattern |

American Airlines New Airbus: A Metaphor for American’s Plan

Examples, Scenarios, and Case Insights

To illustrate the impact of the new food pyramid 2026 USA, let’s look at how a typical American family’s grocery budget and an investor’s sector allocation might change.

The Household Grocery Shift

In 2024, a family might have spent $200 a week, with 60% of their cart consisting of “middle-aisle” processed goods like boxed cereals, snack bars, and frozen pizzas. Under the 2026 guidelines, that family shifts toward the perimeter of the store. They replace sugary cereals with eggs and full-fat yogurt, and trade frozen pizzas for whole cuts of meat and fresh/frozen vegetables. While the “unit price” of meat is higher, the increased satiety from protein and fats often leads to fewer impulsive snack purchases, potentially neutralizing the total weekly spend while significantly improving health markers.

The Investor’s “Real Food” Trade

An investor following the new food pyramid 2026 USA might rotate out of a traditional “S&P 500 Consumer Staples” ETF, which is often heavy in sugary beverage and snack companies. Instead, they might move into a more specialized “AgTech and Regenerative Farming” fund. For example, a company specializing in domestic vitamin manufacturing or Carotenoids—which are essential for the new fortification standards mentioned in the White House’s 2026 health policy briefing—could see significant growth as food manufacturers scramble to meet nutrient-density requirements.

Mike Tomlin Mum on Coaching Future: Why Leadership Stability is an Essential Investment Asset

Common Mistakes and Risks to Avoid

- Misinterpreting “Saturated Fat” Advice: While the new food pyramid 2026 USA “ends the war” on saturated fats, it still suggests a 10% daily calorie limit. The key is sourcing these fats from whole foods (like meat and avocados) rather than processed oils.

- The “Health Halo” Trap: Don’t assume everything labeled “natural” or “organic” fits the new guidelines. Many organic snacks are still ultra-processed and high in added sugars.

- Overlooking Alcohol Guidelines: The 2026 update moves away from specific numeric limits on alcohol, instead advising “less is always better.” For investors, this could signal a long-term cooling of the beverage alcohol sector.

- Ignoring the Multi-Year Transition: While the guidelines are out now, regulations for school meals and federal programs won’t be fully implemented until 2027. Don’t expect an overnight collapse of processed food stocks.

- Neglecting Gut Health: The new guidelines heavily emphasize the gut microbiome. Failure to incorporate fiber-rich vegetables and fermented foods misses a core tenet of the 2026 reset.

Conclusion – Key Takeaways & Next Steps

The release of the new food pyramid 2026 USA marks a turning point in American public health and economics. By pivoting toward whole, nutrient-dense foods and away from the additives that have dominated the modern diet, the USDA and HHS are attempting to rewrite the nation’s health trajectory. For the individual, this is an opportunity to reduce long-term healthcare liabilities by investing in “real food” today. For the investor, it is a signal to re-evaluate the resilience of “Big Food” in a world that is increasingly demanding transparency and nutrition.

Therefore, your next step should be a thorough audit of your own “food economy.” Are your grocery habits and stock holdings aligned with the “Real Food” revolution?

Would you like me to help you analyze the financial reports of specific food manufacturers to see how they are adapting their product lines for the 2026 guidelines? Explore our further resources to stay ahead of the curve in this rapidly evolving market.

2 Comments