When you check your portfolio, it’s easy to focus on just one thing: price. Did your stock go up or down today? However, if you ignore how dividends affect total return, you’re missing a major piece of your long-term wealth-building puzzle.

Total return combines price changes + dividends (and other cash flows). Over decades, dividends and their reinvestment can be responsible for a huge share of equity returns. Understanding how dividends affect total return helps you choose better investments, set realistic expectations, and avoid costly mistakes.

Section 1 – Core Concept/Overview

What Is Total Return – and Where Do Dividends Fit In?

Total return is the overall gain or loss from an investment over a period, including:

- Price return – change in the stock price

- Dividend return – cash payouts you receive

- Reinvestment effects – the growth of shares bought with those dividends

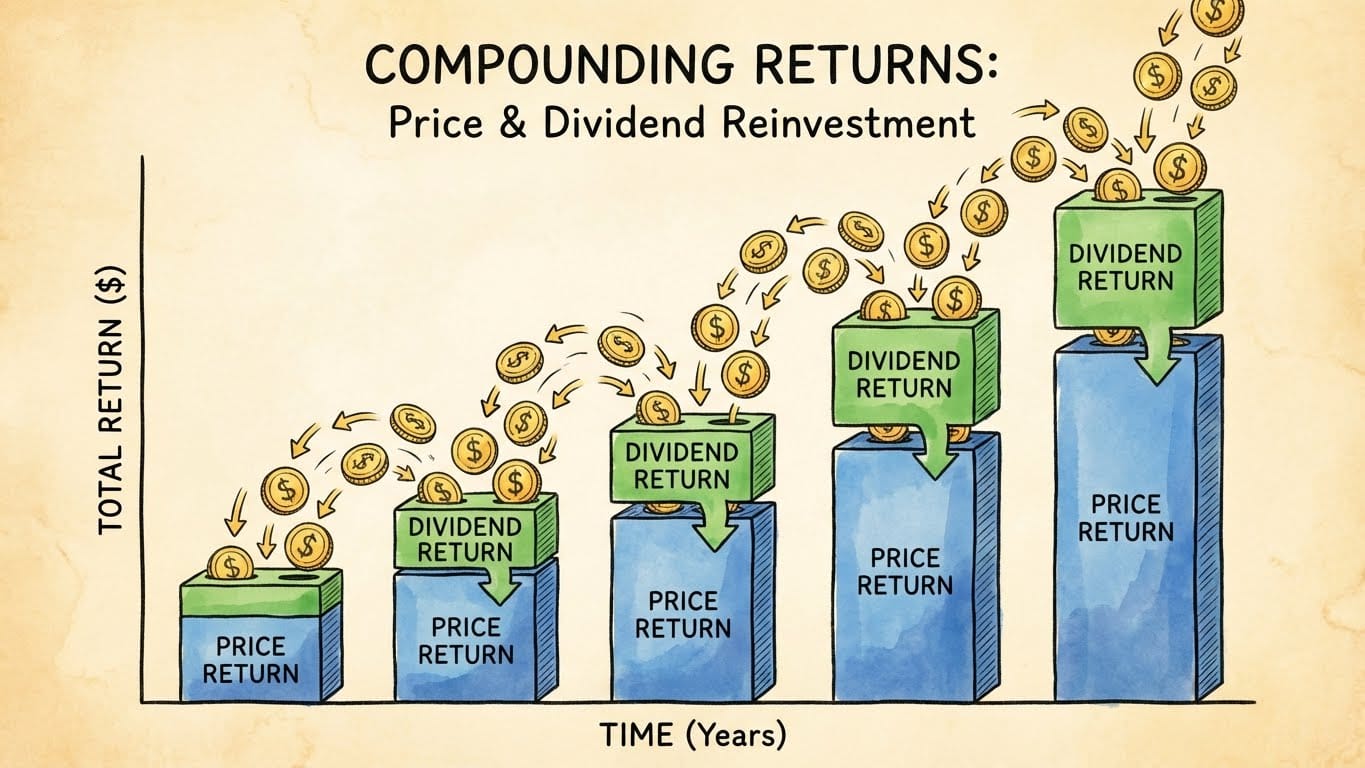

So, how dividends affect total return is straightforward in theory: every dollar of dividend adds to your return, either as cash in your pocket or as extra shares if you reinvest. Over time, those extra shares can generate their own dividends and price growth, creating a compounding effect.

In an environment like 2025–2026, where interest rates are higher than in the ultra-low era and inflation is still a concern in many economies, dividends offer a tangible, recurring source of return rather than relying only on multiple expansion or speculative price moves.

Price Return vs Dividend Return: Two Sides of the Same Coin

To really see how dividends affect total return, you need to separate two components:

- Price return – If you bought a stock at $100 and it’s now $120, your price return is 20%.

- Dividend return – If you received $3 per share in dividends during that time, that’s an additional 3% on your original $100.

Your total return is not just 20% or 3%; it’s the combination:

- Total return ≈ 23% (ignoring reinvestment and taxes)

For index investors, this is why “price-only” indices understate long-term performance compared to total return indices, which assume dividends are reinvested.

Section 2 – Practical Strategies / Framework

Now that you understand how dividends fit into the picture, let’s turn this into a practical framework you can apply.

Step-by-Step Strategy 1 – Using Dividends to Power Compounding

One of the most powerful ways how dividends affect total return shows up is through reinvestment. Instead of spending the cash, you buy more shares.

1. Turn on automatic dividend reinvestment (if it fits your plan)

Most brokers and dividend reinvestment plans (DRIPs) let you automatically use dividends to buy more shares—often with zero commission.

- This converts a 3–4% cash yield into additional shares that can also grow in price.

- Over many years, this dramatically boosts your total return.

2. Prefer “healthy” dividend payers over the highest yields

Focus on companies that:

- Generate consistent free cash flow

- Have a track record of sustainable or growing dividends

- Reinvest enough back into the business to keep earnings growing

This balance matters because how dividends affect total return depends on both cash payouts and future growth. A 4% yield with 6% earnings growth can be more attractive than an 8% yield with no growth and rising risk.

3. Align dividend strategy with your time horizon

- Accumulator phase (building wealth): Reinvest dividends to maximize growth.

- Decumulation phase (retirement): Use dividends as a relatively stable cash flow source, but still watch diversification and business quality.

Step-by-Step Strategy 2 – Blending Dividends and Capital Gains in a Portfolio

A robust portfolio doesn’t rely only on dividends or only on growth; it blends both.

1. Define your desired dividend “role”

Ask yourself:

- Do you want dividends mainly for income, stability, or discipline (forcing management to return cash)?

- How much of your total return do you expect from dividends vs price appreciation?

A common rule of thumb for long-term equity returns is that total return ≈ dividend yield + earnings growth ± valuation changes over time.

2. Build a mix of dividend and growth stocks

You might:

- Hold a core allocation of broad market or dividend ETFs that provide a baseline yield

- Add select individual dividend growth stocks with strong balance sheets and rising payouts

- Complement these with growth companies that reinvest profits instead of paying dividends

3. Rebalance with dividends in mind

When rebalancing your portfolio:

- Consider using fresh contributions and dividend cash to buy underweight assets instead of selling overweights immediately.

- This can reduce trading costs and potential taxable gains while keeping your target allocation intact.

This way, you’re actively using how dividends affect total return to maintain diversification and manage risk.

Section 3 – Examples, Scenarios, or Case Insights

To make it concrete, let’s walk through some simplified numbers that show how dividends affect total return in real-life situations.

Example 1 – Price Return Only vs Dividends Reinvested

Assume:

- You invest $10,000 in a stock or ETF.

- It delivers an average 5% price return per year.

- It also pays a 3% dividend yield, which you either reinvest or take as cash.

- Time horizon: 20 years.

We’ll compare three scenarios (very simplified, ignoring taxes and constant returns just for illustration):

| Scenario | Price Return p.a. | Dividend Yield p.a. | Reinvest Dividends? | Approx. Value After 20 Years |

|---|---|---|---|---|

| A. Price return only | 5% | 0% | N/A | ~$26,500 |

| B. 5% price + 3% dividend, no reinvestment | 5% | 3% | No | ~$26,500 + $6,000 cash paid* |

| C. 5% price + 3% dividend, with reinvestment | 5% | 3% | Yes | ~$43,000+ |

*If you simply spend the dividends, they don’t compound.

In Scenario C, you can clearly see how dividends affect total return: the extra compounding from reinvested dividends significantly boosts your ending value compared to just relying on price gains.

Example 2 – Two Stocks with Different Yield and Growth

Consider two hypothetical stocks over 10 years:

- Stock X: 2% dividend yield, 8% annual price growth

- Stock Y: 6% dividend yield, 2% annual price growth

If you reinvest all dividends:

- Stock X may deliver a total return close to 10–11% per year (2% yield + 8% growth).

- Stock Y may also land near a similar range (6% yield + 2% growth).

However, their risk profiles and tax treatment can differ. This is why you should look beyond the headline yield and understand both growth prospects and payout sustainability when weighing how dividends affect total return in your portfolio.

For more data on how dividends contribute to long-term equity returns globally, you can explore the World Bank’s stock market and returns statistics, which often decompose returns into income and capital gains components.

World Bank – Global Financial Development

Common Mistakes and Risks

When learning how dividends affect total return, it’s easy to slip into some common traps:

- Chasing the highest yield

- Very high yields can signal stress. A 10–12% yield might be unsustainable and at risk of cuts.

- Ignoring dividend safety

- Not checking payout ratios, cash flow, and debt levels can leave you exposed to sudden dividend reductions.

- Forgetting about taxes

- In many countries, dividends are taxed annually, while unrealized capital gains are not. This can reduce the net benefit of high payouts, especially in taxable accounts.

- Focusing only on dividends and ignoring total return

- A high-yield stock that loses 20% of its value is not a good deal. Always look at total return, not just the cash income.

- Overconcentration in one sector

- Many dividend-rich sectors (utilities, REITs, telecoms, banks) can become overcrowded in income portfolios. Sector concentration increases risk.

- Assuming dividends are guaranteed

- Dividends are always at the discretion of the company’s board. They can be cut in recessions, regulatory shocks, or when business conditions deteriorate.

Conclusion – Key Takeaways & Next Steps

Understanding how dividends affect total return is crucial if you want to build durable wealth instead of just chasing short-term price moves. Dividends:

- Provide a steady stream of income that can cushion volatility.

- Become a powerful engine of compounding when reinvested over long periods.

- Must always be evaluated alongside business quality, growth prospects, taxes, and diversification.

In a world where 2025–2026 markets may still face uneven growth, shifting interest rates, and bouts of volatility, knowing how dividends affect total return gives you a practical edge: you can design portfolios that don’t rely solely on optimism about future prices.

Call-To-Action:

Take 15 minutes today to:

- List your top 10 holdings.

- Note their dividend yields, payout ratios, and 5–10 year dividend history.

- Compare your price return vs total return over time.

This quick audit will show you, in your own money, how dividends affect total return—and where you might want to adjust your strategy. Then dive into more articles on dividend sustainability, tax-efficient investing, and portfolio construction to refine your long-term plan.

3 Comments