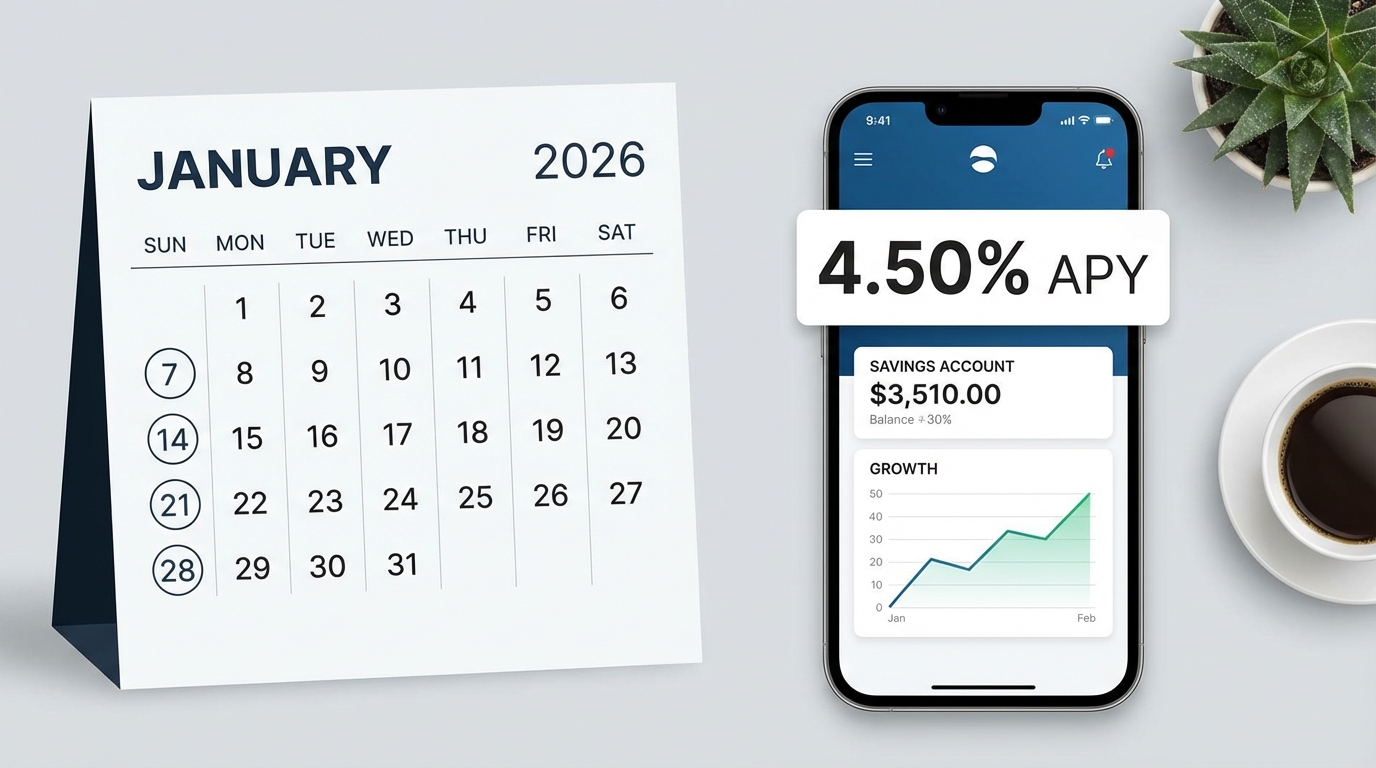

As we navigate the economic landscape of early 2026, savers are facing a pivotal moment. While market volatility and shifting interest rates dominate the headlines, the 10 best high-yield savings accounts for January 2026 continue to offer a safe harbor for your capital, with several top-tier institutions still delivering yields well above 4% APY. For the strategic investor, these accounts are not just “placeholders” for cash; they are high-performance tools for liquidity management and wealth building.

Whether you are padding an emergency fund or stashing away a down payment, the difference between a traditional 0.01% savings account and a high-yield option is stark. In today’s environment, where inflation remains a persistent conversation in macroeconomics, maximizing your passive return on cash is essential to maintaining purchasing power. This guide breaks down the elite performers of the month, the strategies for maximizing your yield, and the common pitfalls to avoid in a shifting rate environment.

Why High-Yield Savings Matter in 2026

The core principle behind a high-yield savings account (HYSA) is simple: it is a deposit account that typically pays a much higher interest rate than a standard savings account. In January 2026, the national average savings rate still hovers below 0.50% APY, yet the 10 best high-yield savings accounts for January 2026 are consistently outperforming that benchmark by nearly ten times. This massive spread allows your money to work significantly harder with zero market risk.

The Role of Digital Banking and Competition

Most of the top rates today come from digital-only banks or the online divisions of traditional financial giants. By operating without the overhead of physical branches, these institutions can pass the savings directly to you in the form of higher APYs. Furthermore, the 2026 landscape has seen increased competition from fintech platforms and credit unions, which use aggressive rates to attract deposits in a tighter liquidity environment.

Liquidity vs. Return: The Hybrid Advantage

One of the most attractive features of an HYSA is that it provides the best of both worlds: competitive returns and high liquidity. Unlike Certificates of Deposit (CDs), which lock your money away for a fixed term, an HYSA allows you to withdraw funds usually up to six times per month without penalty. This makes them the ideal instrument for an emergency fund—a cornerstone of any robust financial plan.

Maximizing Your Interest in 2026

To truly benefit from the 10 best high-yield savings accounts for January 2026, you must do more than just open an account. Strategic placement and automation are key to ensuring you are always earning the top available rate.

The “Tiered Savings” Approach

Many high-yield accounts in 2026 utilize a tiered interest structure. For example, a bank might offer 5.00% APY on the first $5,000 and 3.50% on everything above that. To maximize your returns, you should consider “laddering” your cash across different institutions or moving excess funds into a secondary account that offers a higher base rate for larger balances.

AlgosOne AIAO: The Future of AI-Driven Wealth Building in 2026

Automating the “Sweep”

Modern financial planning tools now allow for “automatic sweeps.” You can set your primary checking account to automatically move any balance above a certain threshold (e.g., $2,000) into your high-yield savings account every Friday. This ensures that every possible dollar is earning interest from day one, rather than sitting idle in a non-interest-bearing checking account.

Actionable Steps for January 2026:

- Verify FDIC/NCUA Insurance: Never deposit funds into an account that isn’t backed by the federal government. This protects your first $250,000 per institution.

- Monitor the “Rate Creep”: HYSA rates are variable. Check your rate at least once a month; if it drops significantly below the top 10 average, be prepared to move your funds.

- Check for Monthly Fees: The best accounts in 2026 have zero monthly maintenance fees. Don’t let a $10 fee eat your interest.

The 10 Best High-Yield Savings Accounts: January 2026

Based on the latest data for late January 2026, these are the top performers currently available to savers. Note that while some offer rates as high as 5%, they often come with specific requirements like direct deposits or balance caps.

| Institution | APY (Jan 2026) | Min. Deposit to Open | Key Requirement |

| Varo Bank | 5.00% | $0 | Direct deposit of $1,000+ required |

| Pibank | 4.60% | $0 | App-only access |

| Newtek Bank | 4.35% | $0 | No minimum balance required |

| Axos Bank | 4.31% | $0 | $1,500 monthly direct deposit |

| Climate First Bank | 4.21% | $50 | No minimum balance |

| Openbank | 4.20% | $500 | Digital subsidiary of Santander |

| Vio Bank | 4.02% | $100 | Online only |

| My Banking Direct | 4.02% | $500 | High-rated mobile app |

| Bread Savings | 4.00% | $100 | Strong history of rate stability |

| SoFi | 4.00% | $0 | Requires SoFi Plus or direct deposit |

Scenario: The Power of 4% APY

Imagine you have $25,000 in a traditional savings account earning 0.05% APY. After one year, you would earn a mere $12.50 in interest. However, by moving that same $25,000 into Newtek Bank at 4.35% APY, you would earn approximately $1,087.50 in interest. That is over $1,000 in “free money” simply for moving your funds to a more efficient institution. This is the simplest way to accelerate your wealth building without adding an ounce of risk.

Common Mistakes and Risks to Avoid

- Chasing “Teaser” Rates: Some accounts offer a massive APY for the first three months before dropping it. Read the fine print to ensure the rate is sustainable.

- Forgetting About Taxes: Remember that interest earned is taxable. If you are in a high tax bracket, consider whether a tax-free Municipal Money Market Fund might be more appropriate.

- Ignoring Transfer Times: Moving money from an online bank back to your local checking can take 1–3 business days. Always keep a “buffer” in your checking for immediate needs.

- Overlooking Inflation: While 4% is great, if inflation is at 3%, your “real” return is only 1%. Don’t rely solely on savings; use them as a foundation for more aggressive investing.

- Long-Term Investing Mindset: Why Most People Never Build Real Wealth

Expert Insight: According to theInternational Monetary Fund (IMF), maintaining a healthy liquid reserve is the primary defense against systemic economic shocks. A high-yield savings account is your “first responder” in a financial crisis.

Key Takeaways & Next Steps

The 10 best high-yield savings accounts for January 2026 provide a rare opportunity to earn substantial passive income while keeping your capital safe and accessible. In a world of complex crypto assets and volatile stock markets, the simplicity of a 4% to 5% guaranteed return is a powerful anchor for any portfolio. Whether you choose a niche digital bank like Pibank or a fintech giant like SoFi, the goal is the same: stop leaving money on the table.

Your savings should be a dynamic part of your financial life. As interest rates fluctuate throughout 2026, staying informed and being willing to “bank-hop” for an extra 0.50% can add thousands to your net worth over the long term.

What is your next step to earn more interest?

Start by identifying one “lazy” account in your portfolio and moving it to one of our top picks today. Would you like me to create a “Savings Comparison Spreadsheet” to help you calculate exactly how much more you could earn by switching banks this month?