The Synopsys fiscal Q4 2025 earnings snapshot landed in a market already obsessed with AI, semiconductor design, and tightening budgets. Synopsys is at the center of all three, and its latest quarter shows how powerful that position has become: record revenue, strong backlog, and deeper integration of its $35 billion Ansys acquisition, all against a still-uncertain global economic backdrop. investor.synopsys.com+1

In this breakdown, we’ll walk through the numbers, the story behind them, and how you can turn the Synopsys fiscal Q4 2025 earnings snapshot into a practical framework for your investing decisions.

Section 1 – Synopsys Fiscal Q4 2025 Earnings Snapshot: Headline Results

Synopsys designs the software and IP that chipmakers and system companies use to build the next wave of AI, automotive, and cloud hardware. That “picks-and-shovels” position showed up clearly in fiscal Q4 2025.

Revenue, EPS, and Growth in the Synopsys Fiscal Q4 2025 Earnings Snapshot

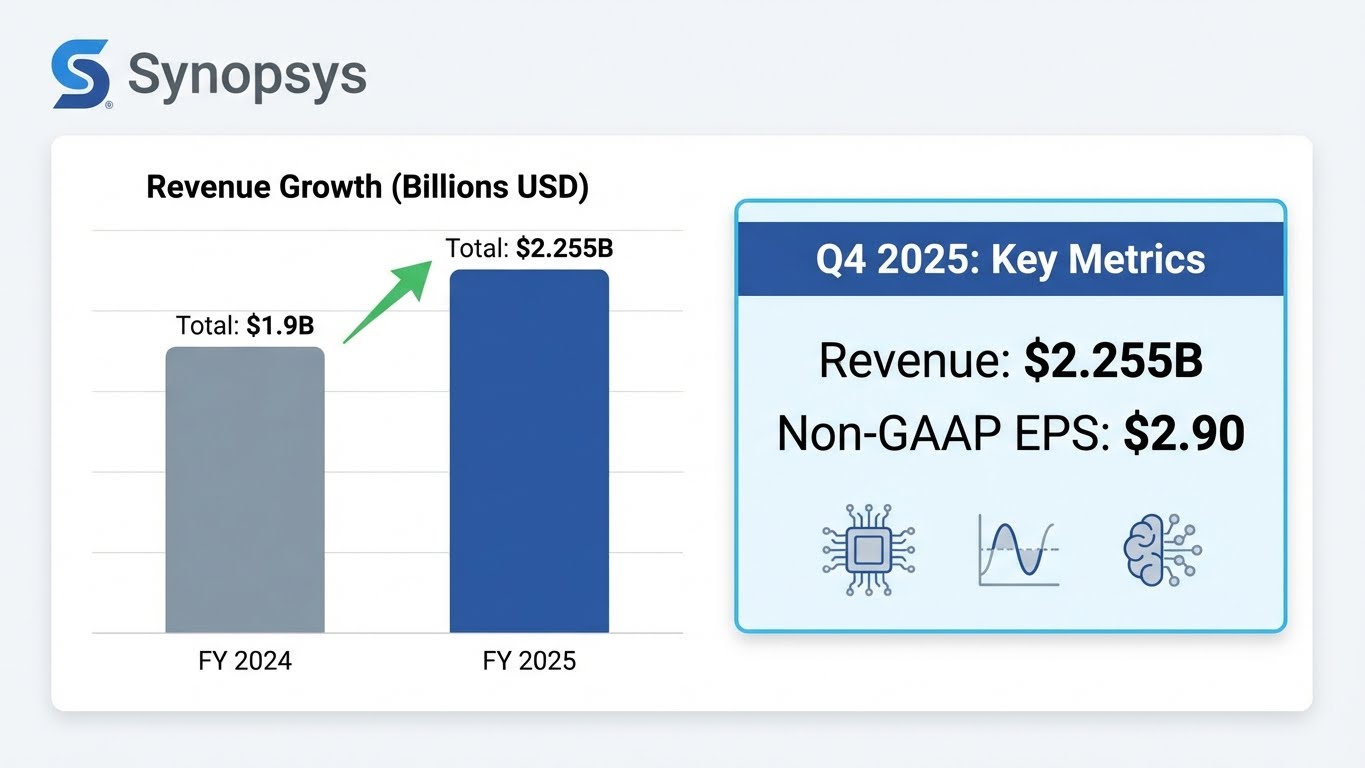

For the quarter ended October 31, 2025, Synopsys reported:

- Q4 revenue: $2.255 billion, up from $1.636 billion a year earlier

- Full-year 2025 revenue: $7.054 billion, about 15% above 2024’s $6.127 billion investor.synopsys.com

- Non-GAAP Q4 EPS: $2.90, versus $3.40 in Q4 2024

- GAAP Q4 EPS: $2.39, up from $1.79 in the prior year investor.synopsys.com+1

Ansys contributed about $668 million of Q4 revenue and roughly $757 million for the full year, highlighting how transformative that acquisition has been. investor.synopsys.com

From Wall Street’s perspective, Synopsys beat earnings expectations (consensus roughly $2.78 non-GAAP EPS) and delivered revenue in line with the $2.25–$2.26 billion range analysts were modeling. Barron’s+1

In short: top line accelerated sharply; earnings were solid, but compressed by acquisition-related amortization, stock-based compensation, and restructuring.

Here’s a quick numeric snapshot:

| Metric | Q4 FY 2025 | Q4 FY 2024 | Direction |

|---|---|---|---|

| Revenue | $2.255B | $1.636B | ▲ higher |

| GAAP EPS | $2.39 | $1.79 | ▲ higher |

| Non-GAAP EPS | $2.90 | $3.40 | ▼ lower |

| Full-year Revenue | $7.054B | $6.127B | ▲ higher |

| Backlog (commentary) | ~$11.4B | N/A | ▲ robust |

(Figures from Synopsys investor relations Q4 FY 2025 release.) investor.synopsys.com+1

Outlook, Ansys Integration, and Nvidia’s $2 Billion Stake

The Synopsys fiscal Q4 2025 earnings snapshot is really about what comes next:

- Fiscal 2026 revenue guidance: about $9.6–$9.7 billion at the midpoint

- This includes $2.9 billion of expected Ansys revenue and a $110 million drag from divested assets like the Optical Solutions Group and PowerArtist RTL businesses. investor.synopsys.com+1

On top of that, Synopsys recently announced a multi-year strategic partnership with Nvidia, including a $2 billion equity investment at roughly $415 per share. The goal is to build GPU-accelerated EDA and simulation tools that compress time-to-market for AI and complex systems. NVIDIA Newsroom+1

Put differently, the Synopsys fiscal Q4 2025 earnings snapshot isn’t just one good quarter. It’s a marker in a broader pivot toward:

- Larger scale (post-Ansys)

- Deeper AI integration (with Nvidia and others)

- A bigger role in simulation and systems, not just chip design

For investors, that raises the stakes: Synopsys is betting heavily that AI-driven engineering will keep growing even as the broader global economy slows to roughly low-3% growth over 2025–2026, according to the IMF’s latest World Economic Outlook. IMF

Section 2 – Practical Strategies for Investors After the Earnings

So what should you actually do with the Synopsys fiscal Q4 2025 earnings snapshot? Here’s a structured framework.

Strategy 1 – Analyze the Growth Story vs. Valuation

First, separate business performance from stock valuation.

Business-wise, Synopsys just showed:

- High-teens full-year revenue growth

- Strong GAAP EPS growth in Q4, despite integration noise

- A much larger addressable market after acquiring Ansys

- A high-visibility backlog above $11 billion investor.synopsys.com+1

Valuation-wise, investors are pricing Synopsys as a compounder, not a typical cyclical semiconductor name:

- Look at forward non-GAAP EPS guidance for FY 2026 (around the mid-$14s per share). investor.synopsys.com+1

- Compare that to the current share price (recently in the mid-$470s). Barron’s+1

- Roughly estimate a forward P/E in the low-to-mid 30s.

Then ask:

- Does that multiple make sense for a business growing high-teens with strong competitive moats?

- How sensitive is your thesis to macro surprises—like slower global growth or tighter export controls?

If you’re a long-term growth investor, the Synopsys fiscal Q4 2025 earnings snapshot suggests durable demand, but also a valuation that leaves little room for major execution missteps.

Strategy 2 – Build a Step-by-Step Decision Checklist

To avoid emotional decisions around earnings day, turn your analysis into a checklist.

Step-by-step investor framework

- Clarify your thesis

- Are you buying Synopsys for AI exposure, EDA leadership, simulation (Ansys), or all of the above?

- Does the quarter strengthen or weaken that thesis?

- Review the financials

- Compare revenue growth, GAAP EPS, and non-GAAP EPS to last year and to guidance.

- Pay attention to segment trends in Design Automation vs. Design IP. investor.synopsys.com+1

- Evaluate the balance sheet and cash flow

- Check leverage, cash position, and free cash flow trends post-Ansys.

- Confirm that integration and restructuring costs look temporary, not structural.

- Update your valuation range

- Use a simple forward P/E or discounted cash flow (DCF) range.

- Plug in management’s revenue and EPS guidance plus your own margin assumptions.

- Set clear portfolio rules

- Define your max position size (e.g., 3–5% of portfolio).

- Decide under what conditions you add, hold, or trim.

- Check the macro backdrop

- Synopsys sells into a global capex cycle—so slower global GDP and higher real rates can dampen demand. IMF forecasts still show modest growth with elevated uncertainty, so assume volatility, not a smooth ride. IMF+1

How to Use ChatGPT to Analyze Risk Tolerance and Build a Diversified Portfolio

Section 3 – Examples and Case Insights

Let’s apply the Synopsys fiscal Q4 2025 earnings snapshot to a few simplified scenarios.

Example 1 – Long-Term Growth Investor

Imagine you’re a 10-year, AI-focused investor.

- You believe AI workloads, chip complexity, and simulation requirements will keep rising through 2030.

- You view Synopsys + Ansys + Nvidia as a powerful ecosystem around “AI-accelerated engineering.” NVIDIA Newsroom+1

Using Q4 data:

- Revenue is already above $7.0 billion annually, with guidance toward roughly $9.6 billion next year. investor.synopsys.com+1

- Non-GAAP EPS in the mid-teens suggests healthy profitability, even after integrating a massive acquisition.

Your approach might be:

- Accept a premium valuation in exchange for durable competitive advantages.

- Dollar-cost average into the position, adding more on pullbacks tied to macro scares rather than company-specific deterioration.

- Watch Ansys integration metrics and Nvidia partnership milestones closely as key proof points.

Example 2 – Quality-at-a-Reasonable-Price (QARP) Investor

Now picture a more valuation-sensitive investor.

You’re attracted to:

- Strong free cash flow

- High switching costs and entrenched customer relationships

- Recurring revenue from long-term contracts

But you’re wary of:

- Paying 30–35x forward earnings in a world where global growth is slowing and rates may stay structurally higher than in the 2010s. IMF+1

Using the Synopsys fiscal Q4 2025 earnings snapshot, you could:

- Set a valuation guardrail, for example:

- Add aggressively below 28–30x forward EPS

- Hold/trim if the multiple expands beyond 35x without a material raise in guidance

- Use the company’s 2026 revenue and EPS targets as your base case, then haircut them for potential export-control or restructuring surprises. investor.synopsys.com+2Reuters+2

Example 3 – Risk-Focused Investor After Big Layoff News

Synopsys recently announced a restructuring plan involving roughly 10% workforce reductions, tied to the Ansys acquisition and earlier revenue disappointments in Q3 2025. Reuters+1

If you prioritize downside protection, you might:

- Treat the Synopsys fiscal Q4 2025 earnings snapshot as a baseline check that restructuring is translating into improved margins and not eroding innovation.

- Track operating margin trends and R&D spending; a sharp, sustained drop in R&D would be a red flag for a long-term technology leader.

- Size the position smaller until you see at least one or two more quarters of clean execution.

Common Mistakes and Risks

Even with a strong Synopsys fiscal Q4 2025 earnings snapshot, there are real risks to watch:

- Focusing only on non-GAAP EPS

- GAAP results include amortization, stock-based compensation, and restructuring. Ignoring them can make profitability look better than it truly is over time. investor.synopsys.com

- Underestimating integration risk with Ansys

- Combining two complex software businesses is never trivial. Delayed synergies, culture clashes, or customer confusion could drag on growth.

- Ignoring export-control and geopolitical risk

- Synopsys has already faced uncertainty over U.S. export rules to China, which can impact revenue visibility and guidance confidence. MarketWatch+1

- Assuming AI guarantees infinite growth

- AI design and simulation demand can grow rapidly, but budgets are still cyclical and sensitive to broader capex trends and global GDP.

- Overconcentration in one theme

- Piling too much of your portfolio into a single AI-design winner raises idiosyncratic risk—no matter how strong the story looks today.

- Trading only around headlines

- Earnings-day volatility can be sharp. Without a predefined plan, it’s easy to buy high on euphoria or sell low on fear.

Conclusion – Key Takeaways & Next Steps

The Synopsys fiscal Q4 2025 earnings snapshot confirms that the company has successfully scaled beyond traditional EDA into a broader engineering-solutions platform, powered by the Ansys acquisition and a deep Nvidia partnership. Revenue is growing rapidly, backlog is strong, and guidance points to continued expansion into 2026. investor.synopsys.com+2Barron’s+2

At the same time, the picture isn’t risk-free:

- Non-GAAP EPS growth is flatter than revenue as integration, stock compensation, and restructuring weigh on margins.

- Export-control shocks and macro slowdown remain credible threats. MarketWatch+1

Your next steps:

- Decide what role Synopsys should play in your portfolio: core AI infrastructure, tactical growth, or nothing at all.

- Use the numbers from the Synopsys fiscal Q4 2025 earnings snapshot to build a simple valuation range and risk checklist.

- Set clear rules for adding, holding, or trimming—so you respond to future quarters with discipline instead of emotion.

If you want to go deeper, continue your research with:

Use this Synopsys fiscal Q4 2025 earnings snapshot as a starting point—not the final word—for your long-term investment decision.