If you earn, spend, or invest across borders, the USD to INR exchange rate is no longer just a number on Google—it directly affects your real-life cash flow and returns. In late 2025, the rupee crossed the psychologically important 90-per-dollar level for the first time, making USD holdings more valuable in INR terms and raising questions about inflation, imports, and long-term currency risk.

In this guide, you’ll learn what drives the USD/INR moves, how to think about the USD to INR exchange rate as a traveler, freelancer, or investor, and how to protect yourself from volatility in 2025–2026.

Section 1 – Core Concept/Overview

What the USD to INR Exchange Rate Actually Means

At its simplest, the USD to INR exchange rate tells you how many Indian rupees you receive for one U.S. dollar. When you see something like 1 USD ≈ 90 INR, it means:

- Earning in USD gives you more purchasing power in India than when the rate was 80.

- Importers and Indian companies paying in dollars face higher costs.

- The rupee has weakened against the dollar over time.

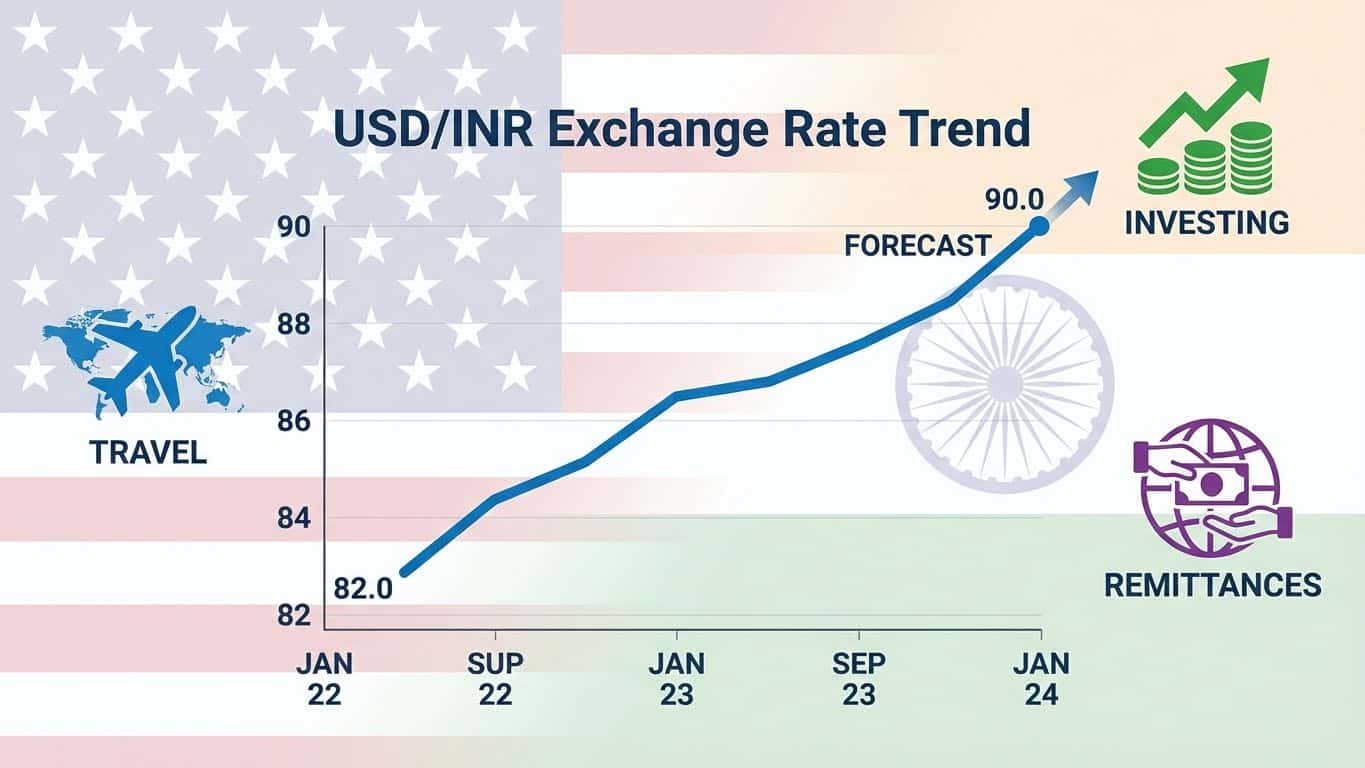

In 2025, USD/INR climbed to around 90.1–90.3, a record high, after averaging roughly 86–87 earlier in the year. This move reflects both dollar strength and rupee-specific pressures.

For anyone dealing with cross-border money—NRIs, exporters, freelancers, or global investors—the USD to INR exchange rate is a key variable in planning incomes, expenses, and portfolio returns.

Macro Forces Driving the USD to INR Exchange Rate in 2025–2026

The rupee’s slide is not random. Several factors are pushing the USD to INR exchange rate higher:

- Capital Outflows and Trade Deficit

- Foreign investors have pulled billions from Indian equities in 2025, while a record merchandise trade deficit has widened India’s external financing needs.

- U.S. Tariffs and Trade Tensions

- Higher U.S. tariffs on Indian exports and the absence of a finalized trade deal have weighed on sentiment, increasing demand for dollars and pressure on the rupee.

- Global Interest Rate Differentials

- Emerging market currencies, including the rupee, have faced depreciation as rate gaps vs. the U.S. shifted and investors sought safer dollar assets.

- RBI’s “Shock Absorber” Approach

- The Reserve Bank of India (RBI) operates a managed float regime: it doesn’t target a fixed level but intervenes to smooth volatility. Recent commentary describes the rupee as acting as a “shock absorber” amid global uncertainty, with interventions calibrated to avoid burning too many reserves.

The big picture: the USD to INR exchange rate is shaped by both domestic fundamentals (growth, inflation, deficits) and global forces (U.S. rates, risk sentiment, trade policy).

Section 2 – Practical Strategies / Framework

Now let’s move from theory to action. How should you use information about the USD to INR exchange rate in real life?

Strategy 1 – Step-by-Step Guide for Travelers, Freelancers, and Remitters

If you’re sending or spending money across USD and INR, small changes in the rate can add up.

1. Get a Real-Time Reference Rate

- Check a reputable source (your bank, a major FX site, or RBI’s reference rate) to see the mid-market USD to INR exchange rate.

- This is your benchmark before fees and margins.

2. Compare Conversion Channels

Banks, fintech apps, and money transfer services all add their own spread.

- Look at:

- Rate offered vs. mid-market

- Fixed fees

- Transfer limits and speed

Even a 0.5–1.0 INR difference in the USD to INR exchange rate can be significant on large transfers.

3. Time Non-Urgent Transfers

- If your transfer is not urgent, watch the rate over several days or weeks.

- For recurring needs (like sending money home monthly), consider averaging by splitting a large transfer into smaller ones across the month.

4. Match Currency to Expenses

- If you earn in USD but spend mostly in INR, converting progressively as you incur costs may reduce timing risk.

- If you’ll pay future expenses in USD (e.g., tuition), consider keeping some savings in dollars rather than converting everything at once.

Strategy 2 – Step-by-Step Approach for Investors and NRIs

As an investor, you care about the USD to INR exchange rate because it affects your returns when converted back to your home currency.

1. Decide Your “Home Currency”

- If you ultimately plan to retire in India, you may treat INR as your base.

- If your long-term spending will be in USD, treat dollars as home.

This decision shapes how you view gains and losses from currency moves.

2. Look at Currency-Adjusted Returns

Example:

- You invest $10,000 in a U.S. ETF.

- The ETF returns 8% in USD over a year → $10,800.

- If USD/INR moves from 85 to 90, your INR value goes from 850,000 to 972,000 – more than the 8% asset return thanks to currency gains.

But this can work in reverse if the rupee strengthens. Always evaluate investment return + currency effect.

3. Diversify Currency Exposure

- Avoid putting 100% of your wealth into USD assets just because the USD to INR exchange rate has been rising.

- Combine:

- Indian equities and bonds (INR exposure)

- Global funds or ETFs (USD + other currencies)

- Possibly hedged products if available and cost-effective

4. Consider Hedging for Large Exposures

For very large portfolios, currency risk can be managed using:

- Forwards or futures on USD/INR

- Options or structured notes

- Currency-hedged mutual funds/ETFs

The IMF highlights that managing foreign-currency risk is especially important for emerging markets and entities with significant FX mismatches.

Section 3 – Examples, Scenarios, or Case Insights

To see how the USD to INR exchange rate plays out, let’s look at three practical cases.

Example 1 – Traveler from the U.S. to India

- Budget: $3,000 for a trip

- Scenario A: USD/INR = 82

- Cash in INR ≈ 246,000

- Scenario B: USD/INR = 90

- Cash in INR ≈ 270,000

You gain roughly 24,000 INR in spending power purely because the USD to INR exchange rate moved in your favor. Even after higher local inflation, that’s meaningful extra room in your travel budget.

Example 2 – Indian Freelancer Paid in USD

- Monthly invoice: $2,000

- At 82, you receive ≈ 164,000 INR

- At 90, you receive ≈ 180,000 INR

A weaker rupee boosts your rupee income—even if your USD rate doesn’t change. However, if your costs (software, subscriptions, gadgets) are in USD, your advantage shrinks.

Example 3 – NRI Investing Back into India

Suppose you are an NRI investing in Indian equities:

- Initial investment: $20,000 when USD/INR = 85 → 1,700,000 INR

- After 2 years: your INR portfolio grows 25% → 2,125,000 INR

- USD/INR now = 90

Back in USD, your portfolio value is ≈ 2,125,000 / 90 ≈ $23,611.

Your INR return is 25%, but your USD return is about 18%, because the rupee weakened further during your holding period. That’s the double-edge of the USD to INR exchange rate: it can enhance your returns in one currency while eroding them in another.

Summary Table – How USD to INR Moves Affect You

| Role | Direction of Move | Impact Highlight |

|---|---|---|

| U.S. traveler to India | USD/INR rises | More rupees per dollar, higher local spending power |

| Indian importer paying in USD | USD/INR rises | Import costs and margins get squeezed |

| Freelancer paid in USD | USD/INR rises | Higher rupee income (if expenses mostly in INR) |

| NRI investing in India | USD/INR rises | INR gains look smaller when converted back to USD |

Common Mistakes and Risks

When dealing with the USD to INR exchange rate, watch out for these pitfalls:

- Chasing short-term moves

- Trying to perfectly time every transfer or trade based on daily swings can lead to stress and poor decisions.

- Ignoring fees and spreads

- A “great” USD/INR headline rate is irrelevant if your provider adds a big hidden margin.

- Over-concentrating in one currency

- Betting everything on USD or everything on INR exposes you to shocks from trade disputes, policy changes, or global risk-off events.

- Underestimating macro risk

- Emerging market currencies can be hit hard when global uncertainty spikes; recent IMF analysis warns that FX volatility and settlement risks can strain EM foreign exchange markets.

- Assuming the trend will never reverse

- Just because the USD to INR exchange rate is near 90 now doesn’t mean it will move in a straight line forever. Policy shifts, trade deals, and growth surprises can change direction.

- Ignoring your personal “base currency”

- Focusing only on nominal returns in USD or INR without checking what matters for your future spending can mislead you about your true performance.

Conclusion – Key Takeaways & Next Steps

The USD to INR exchange rate is more than a curiosity—it’s a critical input for anyone earning, spending, or investing across the U.S.–India corridor. In 2025–2026, rupee weakness and global uncertainty are likely to keep currency risk on center stage.

The key lessons:

- Understand what drives the USD to INR exchange rate: interest rates, capital flows, trade balances, and RBI policy.

- Treat currency like any other risk: define your home currency, diversify exposures, and avoid oversized bets on one FX direction.

- For day-to-day decisions—travel, remittances, invoices—focus on getting fair pricing, comparing providers, and avoiding emotional timing decisions.

If you build a simple framework and stick to it, you can use the USD to INR exchange rate to your advantage instead of letting it surprise you.

Call to Action:

Review your current USD and INR exposures today. List your income sources, debts, and investments by currency, and ask: If the rupee moves another 5–10% either way, what happens to me? Then explore more guides on managing currency risk, global diversification, and cross-border investing so your financial plan stays resilient—no matter where USD/INR trades next.