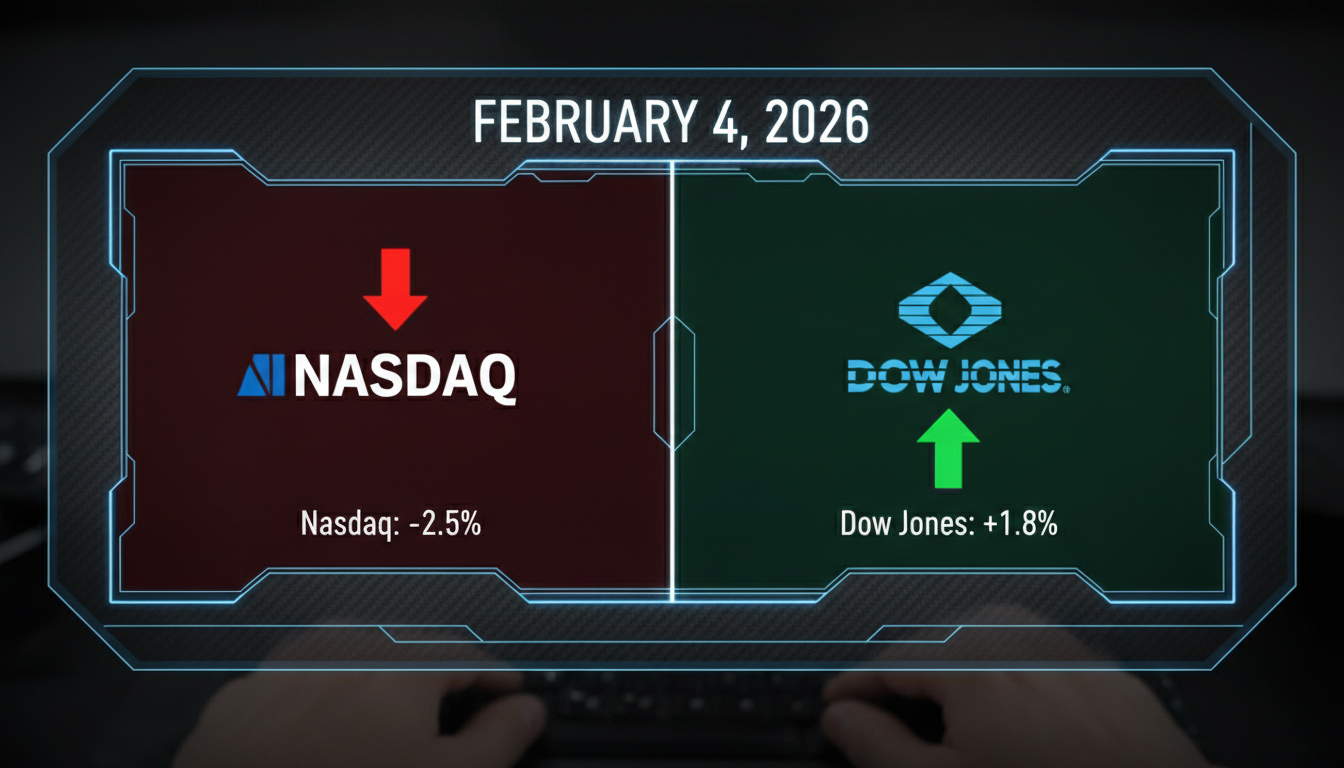

The financial landscape witnessed a striking “Great Divergence” in the US stock market today February 4 2026, as investors aggressively rotated capital out of high-flying technology names and into defensive value plays. While the Nasdaq Composite endured a bruising 300-point slide, the Dow Jones Industrial Average defied the gravity of tech volatility to notch fresh intraday records. This significant shift in money flow highlights a growing “reality check” for the artificial intelligence (AI) trade, which has dominated indices for the better part of three years. For wealth builders, understanding the mechanics of the US stock market today February 4 2026 is not just about tracking daily gains; it is about recognizing the structural rebalancing that defines the mid-cycle economy of 2026.

The Great Divergence in 2026

The primary theme of the US stock market today February 4 2026 is the profound decoupling of growth and value. For years, the “Magnificent Seven” and their semiconductor cousins acted as a monolithic force, lifting all major indices simultaneously. However, today’s session proved that the market is becoming increasingly fragmented. As institutional “smart money” flows out of overextended software and hardware sectors, it is seeking refuge in companies with high free cash flow and attractive dividend yields—a classic sector rotation.

The AI “Reality Check” and Tech Pullback

A key component of the US stock market today February 4 2026 was the sharp sell-off in semiconductor and AI infrastructure stocks. Advanced Micro Devices (AMD) issued a first-quarter revenue forecast that failed to satisfy the market’s insatiable expectations, triggering a massive 15.4% collapse in its share price. This “canary in the coal mine” led to a broader contagion across the sector, with Nvidia falling 3% and Palantir sliding nearly 12%. This pullback suggests that investors are no longer willing to pay extreme premiums for “future potential” and are instead demanding immediate, tangible earnings results.

Value Resilience: Why the Dow is Hitting Records

Conversely, the Dow Jones Industrial Average rose by 265 points, closing near 49,506. This resilience was powered by strong earnings from healthcare giants like Amgen, which surged over 6%, and steady demand for consumer staples like Walmart. The US stock market today February 4 2026 illustrates a market that is maturing; as the Federal Reserve maintains interest rates in the 3.5%–3.75% range, the “higher-for-longer” environment is starting to favor established businesses with robust balance sheets over high-beta growth stocks.

Practical Strategies for Tracking Money Flow

To navigate the US stock market today February 4 2026 successfully, you must transition from a “buy-and-hold tech” mindset to an active “sector rotation” framework. Money flow represents the net movement of capital into or out of specific asset classes, and tracking it allows you to stay ahead of institutional shifts before they reflect in broad index prices.

Strategy 1: Using Sector ETFs to Identify Relative Strength

One of the most effective ways to capitalize on the US stock market today February 4 2026 is to compare the performance of sector-specific ETFs. By tracking the Ratio Chart of the XLK (Technology) versus the XLV (Healthcare) or XLI (Industrials), you can visualize where the momentum is moving. Currently, the “Money Flow Index” (MFI) for technology has entered overbought territory, while Industrials are showing a bullish divergence, suggesting that the current rotation has more room to run throughout the remainder of the quarter.

Strategy 2: Monitoring Treasury Yields as a Sentiment Gauge

In the US stock market today February 4 2026, the 10-year Treasury yield hovered around 4.27%. This level is a critical psychological threshold for equity investors. When yields stabilize at these elevated levels, it acts as a gravity well for tech valuations. Consequently, you should watch for a “steepening” yield curve, which historically signals that investors are pricing in resilient economic growth rather than an imminent recession.

Actionable Steps for Your Portfolio:

- Rebalance your “AI Exposure”: If your tech holdings exceed 35% of your total portfolio, consider trimming 5–10% to lock in gains and moving that capital into undervalued cyclicals.

- Audit your dividend-growth stocks: Look for companies that have increased dividends consistently through the 2024–2025 inflation cycle.

- Track the “Equal-Weight” S&P 500: Use the ticker RSP to see if the average stock is participating in the rally, or if it is just a few mega-caps skewing the data.

- Utilize stop-losses on momentum plays: Given the volatility seen in the US stock market today February 4 2026, use trailing stops to protect your capital from sudden 10% drawdowns.

A $10,000 Portfolio Shift Scenario

Let’s examine how a proactive investor might have handled the volatility of the US stock market today February 4 2026 with a practical numeric example. Suppose you started the year with a $10,000 “Growth-Heavy” allocation.

The Shift from Growth to Value

Before today’s rotation, a tech-heavy portfolio might have seen $7,000 in the Nasdaq and $3,000 in the Dow. With the Nasdaq falling 1.4% and the Dow rising 0.5% in the US stock market today February 4 2026, your tech portion would have lost $98, while your value portion gained $15.

| Asset Class | Old Allocation (Jan) | New Allocation (Feb 4) | Result of Rotation |

| Technology (QQQ) | $7,000 | $6,000 | Profit secured, risk reduced. |

| Healthcare (XLV) | $1,500 | $2,000 | Benefiting from Dow record highs. |

| Industrials (XLI) | $1,000 | $1,500 | Capturing cyclical “money flow.” |

| Cash/Short-Term | $500 | $500 | Liquidity for the next “dip.” |

By proactively shifting $1,000 from tech into healthcare and industrials prior to the close of the US stock market today February 4 2026, you would have effectively mitigated the impact of the AMD-led chip crash. This is the essence of active wealth building in 2026: it’s not about avoiding the market; it’s about being in the right corner of the market at the right time.

The International Monetary Fund (IMF) recently raised its 2026 global growth forecast to 3.3%, citing that AI-related productivity is finally filtering into the “real economy.” This supports the long-term case for industrials and services, even if the “chip makers” themselves are seeing a temporary valuation reset.

As you analyze the US stock market today February 4 2026, be mindful of these common pitfalls that can erode your wealth:

- Panic Selling Quality Tech: While the Nasdaq is down, companies with dominant market positions and high margins (like Alphabet or Microsoft) are often “thrown out with the bathwater.” Do not sell “quality” just because “momentum” is cooling.

- Chasing the Dow at Record Highs: “Buying the top” in industrials can be just as dangerous as holding overvalued tech. Ensure the P/E ratios of your value picks are still within historical norms.

- Ignoring the “Sticky Inflation” Factor: With US inflation remaining around 2.7%, the Fed is unlikely to cut rates aggressively. Avoid companies that are overly dependent on “cheap money” to survive.

- Failing to Diversify Internationally: As noted in the US stock market today February 4 2026, Japan’s Nikkei 225 surged nearly 4%. Limiting your portfolio strictly to US assets misses out on the global “rebound” trade.

The US stock market today February 4 2026 has provided a clear roadmap for the remainder of the year. The transition from a tech-centric rally to a broader, value-oriented expansion is well underway. While the headlines may focus on the 300-point Nasdaq drop, the real story is the underlying strength of the “old economy” and the resilience of the Dow.

To succeed in this environment, you must remain disciplined. Keep a close eye on the money flow into healthcare and consumer staples, as these sectors are currently acting as the market’s “ballast.” As we look ahead to Friday’s Non-Farm Payrolls report, the US stock market today February 4 2026 serves as a vital reminder that diversification and fundamental analysis are your best tools for long-term wealth building.

Would you like me to create a detailed watchlist of the healthcare and industrial stocks that led the Dow’s record-breaking move in the US stock market today February 4 2026?