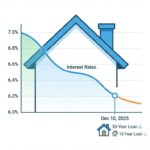

The third straight Fed interest rate cut has just landed, and markets are buzzing. In its December 2025 meeting, the Federal Reserve lowered the federal funds target range again to about 3.50%–3.75%, marking the third consecutive cut since September as it tries to balance a cooling job market with still-elevated inflation. ويكيبيديا+2mint+2

If you’re wondering what this actually means for your savings, debt, and investments, this article will walk you through it step by step—so you can turn the third straight Fed interest rate cut into a strategic advantage instead of a source of confusion.

Why the Third Straight Fed Interest Rate Cut Matters for Investors

When the Fed moves three meetings in a row, it’s not a minor tweak—it’s a policy shift.

The federal funds rate is the short-term rate banks charge each other for overnight loans. But it cascades through the entire financial system:

- What banks pay you on savings and money market accounts

- What you pay on mortgages, credit cards, auto loans, and business loans

- How investors value stocks, bonds, and real estate

In 2025, the Fed has been cutting from the mid-4% range down into the mid-3% range to support a slowing labor market while inflation remains above its 2% target. ويكيبيديا+2Investopedia+2 That’s the backdrop for this third straight Fed interest rate cut.

For a detailed, official view of each decision, you can always read the latest Federal Reserve FOMC statement. ويكيبيديا

How Fed Rate Cuts Affect Growth, Inflation, and Markets

Here’s the basic chain reaction when the Fed cuts:

- Cheaper borrowing:

Lower policy rates gradually reduce borrowing costs on variable-rate products—like some credit cards, home equity lines of credit (HELOCs), and business loans. - Pressure on savings yields:

Banks and money market funds often respond by trimming yields on savings accounts, CDs, and cash-like products. - Support for risk assets:

Lower rates can raise stock and real estate valuations, because future cash flows are discounted at a lower rate. That’s one reason why markets often rally after a cut—at least initially. ABC News+1 - Signal about the economy:

A single cut might be fine-tuning. A series of cuts—like the third straight Fed interest rate cut—usually signals the Fed is more concerned about growth and the job market than about keeping policy tight.

What a Third Straight Fed Interest Rate Cut Signals About the Economy

A third straight Fed interest rate cut typically signals:

- Growth is slowing:

Job creation is cooling, business investment is softer, or financial conditions were too tight. - Inflation risks are shifting:

Inflation may still be above target, but the Fed believes the risk of a downturn is now high enough to justify easing. - The committee is divided:

In late 2025, several Fed officials have dissented, disagreeing on how aggressively to cut and how quickly to move in 2026. Investopedia+1

For you as an investor, the key is not to guess what the Fed will do next week, but to position your finances for a world where money is slightly cheaper—but uncertainty is higher.

Practical Strategies After a Third Straight Fed Interest Rate Cut

You don’t control Fed policy—but you do control your balance sheet and portfolio. Here’s how to respond strategically.

Strategy 1 – Reposition Your Portfolio for a Lower-Rate Environment

A lower-rate environment reshapes the risk/return profile of major asset classes:

- Bonds

- Short-term bonds and cash may see yields drift lower over time.

- Intermediate and longer-term bonds can benefit as rates fall, potentially delivering price gains.

- Consider whether your bond allocation is too concentrated in ultra-short-term instruments now that the third straight Fed interest rate cut has improved prospects for slightly longer duration.

- Equities (stocks)

- Rate-sensitive sectors—REITs, utilities, and some dividend stocks—often get support from lower yields.

- Growth stocks may also benefit as lower discount rates boost the value of long-dated earnings.

- However, if cuts are driven by economic weakness, cyclical sectors (like industrials or small caps) can remain volatile.

- Real estate

- Lower mortgage rates can support home prices and real-estate investment, but if the economy slows too much, demand can still suffer.

A simple approach is to revisit your target asset allocation and ask: Does this still match my time horizon and risk tolerance in a world of slower growth and lower rates?

Coca-Cola Testing Major Change: What It Means for Long-Term Investors

Strategy 2 – Optimize Your Debt, Savings, and Cash Flows

The third straight Fed interest rate cut is also a personal finance opportunity:

- Review all variable-rate debts

- Credit cards, HELOCs, adjustable-rate mortgages (ARMs), margin loans.

- Ask your lenders how quickly cuts are passed through—and whether refinancing to a fixed rate makes sense.

- Re-shop your savings rate

- Not all banks cut at the same pace.

- Compare high-yield online savings accounts and money market funds before your yield quietly drifts lower.

- Adjust your emergency fund strategy

- With lower yields on cash, you still need a 3–6 month emergency fund, but you might use a mix of:

- High-yield savings

- Short-term Treasury funds

- Carefully laddered CDs

- With lower yields on cash, you still need a 3–6 month emergency fund, but you might use a mix of:

- Update your financial assumptions

- In your long-term plan, revise assumptions for:

- Expected cash returns

- Mortgage rates on future home purchases

- Business borrowing costs

- In your long-term plan, revise assumptions for:

Here’s a quick action checklist to execute within the next 30 days:

- List all your debts with balances, rates, and whether the rate is fixed or variable.

- Identify which debts are most sensitive to the third straight Fed interest rate cut.

- Get at least two refinance quotes for mortgages, HELOCs, or business loans.

- Compare your savings rate against top online banks and money market funds.

- Rebalance your portfolio back to your target allocation, using new contributions where possible.

- Document updated assumptions in your financial plan or spreadsheet.

Examples: How the Third Straight Fed Interest Rate Cut Plays Out in Real Life

Let’s make this concrete with simple, realistic scenarios.

Example 1 – Credit Card and HELOC Borrower

Suppose you carry:

- $10,000 in credit card debt at a variable APR linked to prime, and

- A $200,000 HELOC also tied to short-term benchmark rates.

If cumulative Fed cuts since September total 0.75 percentage points, your APR might fall by roughly 0.75% as your bank passes through the change (many do so with a lag).

- On the credit card:

- 0.75% lower APR on $10,000 could save around $75 per year in interest if your balance stayed constant.

- On the HELOC:

- 0.75% lower rate on $200,000 could reduce interest by about $1,500 per year, assuming similar pass-through.

Those savings aren’t guaranteed—banks may adjust spreads—but the direction is clear: a third straight Fed interest rate cut can free up cash flow if you act quickly and negotiate when needed.

Example 2 – 60/40 Investor in a Balanced Portfolio

Imagine you have a $100,000 portfolio:

- 60% in diversified equities

- 40% in intermediate-term bonds

If yields move lower after the third cut:

- Bond prices may rise modestly, giving you a capital gain on the bond side.

- Equities may react positively at first as discount rates fall, but if the cuts are driven by recession fears, volatility can stay elevated.

The right move is typically not to swing wildly between 100% stocks and 100% cash. Instead:

- Rebalance back to 60/40 if the market move has skewed your allocation.

- Use fresh contributions to add to underweight areas instead of timing short-term swings.

Example 3 – Small Business Owner

A small business with a $500,000 variable-rate line of credit might see borrowing costs decline after three consecutive cuts. That can:

- Lower monthly interest expense

- Free up cash for inventory, hiring, or marketing

- Improve the odds of surviving a softer economic patch

However, if sales slow due to weaker demand, the business still needs to protect cash flow, even with slightly cheaper credit.

Quick Asset-Class Impact Snapshot

| Asset / Area | Impact of Third Straight Fed Rate Cut | What It Means for You |

|---|---|---|

| Cash & Savings | Yields likely drift lower over time | Re-shop accounts; don’t leave large balances at 0% |

| Short-Term Bonds | Yields decline; prices fairly stable | Still solid for liquidity, but return outlook moderates |

| Intermediate Bonds | Potential price gains as yields fall | Consider modestly extending duration (within your risk) |

| Equities | Valuations supported by lower discount rates, but volatile | Stay diversified; don’t chase short-term rallies |

| Real Estate | Cheaper financing, but tied to overall growth | Opportunities if income is stable and debt is prudent |

| Variable-Rate Debt | Interest costs may decline gradually | Refinance or negotiate to lock in better terms |

Common Mistakes and Risks

Rate cuts are not a free lunch. Avoid these common mistakes:

- Assuming cuts guarantee a bull market

Markets can rally on the news, but if cuts are driven by recession risks, volatility can return quickly. - Chasing high-yield, high-risk products

Don’t stretch into opaque credit products or speculative assets just because safe yields fall. - Going all-in on long-duration bonds without a plan

Longer bonds can benefit from cuts—but they can also fall sharply if inflation surprises on the upside later. - Ignoring inflation and real returns

Even after the third straight Fed interest rate cut, inflation remains above 2% in many forecasts. Focus on real (after-inflation) returns. Investopedia - Over-leveraging because money “feels cheap”

Lower rates can tempt households and businesses to borrow too much. A sudden slowdown can still hurt cash flow. - Trying to trade every Fed headline

Short-term Fed guessing is a losing game for most individual investors. Build a rules-based, long-term plan instead.

Conclusion – Key Takeaways & Next Steps

The third straight Fed interest rate cut is a clear signal: policy is shifting toward support as growth slows and inflation gradually cools, but uncertainty remains high.

To make this work for you rather than against you:

- Revisit your asset allocation for a lower-rate, potentially slower-growth world.

- Optimize your debt—especially variable-rate loans and credit lines—while lenders are adjusting.

- Protect your emergency fund and cash management strategy as savings yields change.

- Focus on real returns, diversification, and discipline, not on trying to outsmart every Fed meeting.

If you want to go deeper, explore more guides on how interest rates shape stock valuations, bond strategies, and debt management in a changing macro environment:

Use this third straight Fed interest rate cut as a trigger to clean up your finances, refresh your investment plan, and position yourself for the next phase of the cycle.