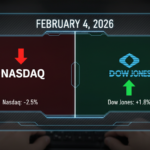

The pulse of the Stock Market Today February 3 2026 is vibrating with a clear signal: the era of blind tech-buying is giving way to a more disciplined, fundamental-driven approach. As the opening bell rang this Tuesday morning, the market reflected the “February Reset” we’ve been tracking throughout the first quarter. With the Federal Reserve maintaining interest rates in the 3.5% to 3.75% range, the Stock Market Today February 3 2026 is characterized by a significant “Tech Rotation,” where investors are moving capital out of over-extended semiconductor stocks and into high-quality industrials and energy plays. For anyone focused on long-term wealth building, understanding this pivot is not just optional—it is essential for survival in the 2026 economic landscape.

The Maturity of the 2026 Market Cycle

The primary driver behind the Stock Market Today February 3 2026 is the “Great Rotation.” After nearly three years of the Artificial Intelligence (AI) supercycle driving the S&P 500 and Nasdaq 100 to record highs, the market has reached a saturation point in high-multiple valuations. Institutional investors are no longer chasing “promises of future growth”; they are seeking “current cash flow.” This transition marks the shift from a speculative phase to a fundamental phase in the current market cycle.

The Fed’s “Higher for Longer” Stabilization

A key pillar of the Stock Market Today February 3 2026 is the Federal Reserve’s stance on monetary policy. By keeping rates steady at the end of January, the FOMC signaled that while inflation is cooling toward 2.4%, they are not ready to trigger a massive easing cycle yet. This “higher for longer” stabilization favors banks and insurance companies, while putting pressure on tech companies that rely on cheap debt to fuel expansion. Consequently, we are seeing a “normalization” of the yield curve, which is fundamentally changing how investors price risk in the equity markets.

The Divergence Between Growth and Quality

In the Stock Market Today February 3 2026, we are witnessing a divergence. High-growth tech is experiencing a “valuation haircut,” while “Quality Value” stocks—those with low debt and high earnings-per-share (EPS) growth—are hitting new 52-week highs. This is the hallmark of a healthy, maturing bull market. Instead of the entire market being dragged down by a tech correction, the capital is simply moving into other sectors, providing a cushion for the broader indices like the S&P 500, which currently holds firm near the 6,892 level.

Amazon Closing Fresh and Go Stores

Practical Strategies for the February 2026 Market

Navigating the Stock Market Today February 3 2026 requires more than just a “buy and hold” mentality; it requires “tactical rebalancing.” As the market shifts, your strategy must evolve to protect your gains from the previous year while positioning for the new leaders of 2026.

Step 1: Implementing a “Barbell Strategy”

Given the volatility in the Stock Market Today February 3 2026, a Barbell Strategy is highly effective. This involves holding extremely safe assets (like short-term Treasuries or high-yield savings) on one end, and high-growth, high-conviction equities on the other, with very little in the “risky middle.” This allows you to benefit from the 3.7% risk-free yields available today while keeping a “moonshot” exposure to the next phase of AI adoption.

Step 2: Transitioning from AI Infrastructure to AI Adopters

The first phase of the AI boom (2023-2025) was about the companies building the chips and servers. In the Stock Market Today February 3 2026, the focus has shifted to “AI Adopters”—the software, healthcare, and logistics companies that are using AI to radically improve their margins.

Actionable Steps for Today’s Investor:

- Trim Tech Winners: If a single tech holding represents more than 10% of your portfolio, consider taking “house money” off the table.

- Monitor the 10-Year Yield: The Stock Market Today February 3 2026 is sensitive to the 10-year Treasury yield. If it spikes above 4.2%, expect further pressure on growth stocks.

- Review Industrial Earnings: Pay close attention to guidance from manufacturing and transport firms; they are the “canaries in the coal mine” for the 2026 economic expansion.

- Utilize Limit Orders: In a high-volatility environment, never buy “at market.” Use limit orders to capture stocks at your preferred entry price during intraday dips.

Portfolio Resilience in 2026

To understand the impact of the Stock Market Today February 3 2026, let’s look at a hypothetical $100,000 portfolio and how it reacts to today’s sector rotation.

Scenario: The $100,000 “Active Rebalancer”

An investor who entered 2026 with a 70% tech-heavy allocation would be seeing a 1.5% drawdown in their portfolio today. However, an investor who rebalanced into a “Quality-Diversified” model based on the trends seen in the Stock Market Today February 3 2026 would likely be flat or slightly up.

| Asset Class | Allocation % | Performance Today | Rationale |

| Mega-Cap Tech | 30% | -2.1% | Profit-taking and valuation reset. |

| Industrial/Energy | 25% | +1.4% | Beneficiaries of the “Rotation.” |

| Fixed Income (Bonds) | 20% | +0.2% | Stability provided by 3.7% yields. |

| International (Japan/EU) | 15% | +0.8% | Diversification away from US tech. |

| Cash/Short-Term | 10% | 0.0% | Liquidity for buying dips. |

Real-Life Application

As demonstrated in the table, the Stock Market Today February 3 2026 rewards those who have spread their risk. While the Nasdaq might be red, the industrials and international segments are providing the necessary “alpha” to keep the total portfolio healthy. According to the International Monetary Fund (IMF), global GDP growth for 2026 is projected at a stable 3.3%, which supports the case for international diversification as US markets consolidate.

The Stock Market Today February 3 2026 is a psychological battlefield. Avoid these common mistakes that often derail wealth building:

- Catching the “Falling Knife”: Buying tech stocks just because they are down 5% without checking if their fundamental story has changed.

- Ignoring Political Risk: With the Fed Chair transition approaching in May 2026, the market will become increasingly sensitive to political headlines.

- Over-concentration: In a “Rotation” market, being 100% in one sector is a recipe for extreme volatility.

- Failing to Take Profits: In 2026, “paper gains” can evaporate quickly. Always have a target sell-price to secure your realized returns.

The Stock Market Today February 3 2026 represents a pivotal moment in the current economic cycle. The shift from “speculative growth” to “quality value” is not a sign of a market collapse, but a sign of market maturity. By understanding the “Great Rotation,” maintaining a diversified barbell strategy, and keeping a close eye on interest rate stability, you can turn today’s volatility into a wealth-building opportunity.

In summary, the key takeaways from the Stock Market Today February 3 2026 are:

- Rotation is Reality: Capital is moving out of tech and into undervalued industrial and energy sectors.

- Quality is King: Focus on companies with strong cash flows and low debt-to-equity ratios.

- Active Management Pays: This is no longer a “set it and forget it” market; rebalancing is crucial.

Would you like me to analyze a specific sector or stock ticker to see how it aligns with the trends of the Stock Market Today February 3 2026? Taking the next step in your financial education is the only way to ensure you stay on the right side of the 2026 market shift