The automotive world was sent into a tailspin this Friday morning as the Stellantis EV write-down hit the headlines with a staggering $26.5 billion (€22.2 billion) impairment charge. This massive accounting adjustment, revealed alongside a preliminary net loss of up to €21 billion for the second half of 2025, represents one of the largest strategic retreats in modern industrial history. As the Franco-Italian giant—owner of iconic brands like Jeep, Ram, and Fiat—struggles with a saturated market and a “demand cliff,” the Stellantis EV write-down underscores a broader, more painful reality: the global transition to electrification is proving far more expensive and volatile than even the most pessimistic analysts predicted. For wealth builders, this event serves as a critical warning sign that the “green premium” in the stock market is rapidly evaporating.

The Anatomy of the $26 Billion Impairment Charge

At its core, the Stellantis EV write-down is an admission that the company’s previous valuation of its electric vehicle (EV) assets, platforms, and battery supply chains was fundamentally disconnected from reality. In accounting terms, a write-down (or impairment charge) occurs when the book value of an asset exceeds its “fair market value” or its ability to generate future cash flows. When a company like Stellantis wipes $26 billion off its balance sheet, it is telling the market that its multibillion-dollar investments in EV-only factories and proprietary battery technology are no longer expected to yield the returns once promised.

The EV “Demand Cliff” and Inventory Glut

The primary driver behind the Stellantis EV write-down is a significant overestimation of the pace of consumer adoption. Throughout 2024 and 2025, legacy automakers raced to build EV capacity, often at the expense of their high-margin internal combustion engine (ICE) portfolios. However, as federal subsidies in the U.S. were rolled back and infrastructure anxiety persisted, the expected surge in buyers never materialized. Consequently, Stellantis was left with a massive inventory of unsold electric Jeeps and Fiats, leading to price wars that decimated profit margins.

Strategic Reset: From “EV-First” to “Freedom of Choice”

The Stellantis EV write-down isn’t just a mathematical adjustment; it is the financial backbone of a complete strategic pivot. Under the leadership of CEO Antonio Filosa, who took the helm in May 2025, the company is moving away from a “command-and-control” electrification mandate toward a “multi-energy” approach. This means prioritizing hybrids and high-efficiency gas engines that meet the “real-world needs” of car buyers. While this pivot preserves the company’s long-term viability, the short-term cost is the massive $26 billion “bill” that has now come due.

(Internal link: related article about [the rise of hybrid vehicles in the 2026 market])

An Investor Framework for the Auto Sector

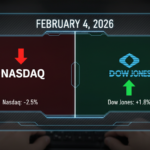

The shockwaves from the Stellantis EV write-down have sent the company’s shares plummeting over 20% in a single day, hitting levels not seen since 2020. For those focused on personal finance and wealth building, the question is no longer about when EVs will take over, but how to protect a portfolio from the collateral damage of this “mountain of losses.”

Strategy 1: Defensive Rebalancing and Dividend Scrutiny

One of the most immediate consequences of the Stellantis EV write-down was the suspension of the company’s 2026 dividend. For income-focused investors, this is a catastrophic event. When a blue-chip stock halts its dividend to preserve its balance sheet, it is a signal to exit or drastically underweight the sector.

Actionable Steps for Investors Today:

- Analyze Free Cash Flow (FCF) Over Net Income: Look for companies that generate actual cash rather than those reporting high accounting profits. In 2026, cash is king.

- Avoid “Pure Play” EV Risks: Unless you have an extremely high risk tolerance, avoid companies that do not have a profitable ICE or hybrid segment to cushion the blow of EV losses.

- Monitor the Debt-to-Equity Ratio: With Stellantis issuing €5 billion in perpetual hybrid bonds to shore up its 46-billion-euro liquidity, debt management is now a primary metric for safety.

- Diversify into Infrastructure: Instead of betting on the car makers themselves, consider the “picks and shovels” approach by investing in electrical grid upgrades and universal charging hardware.

Strategy 2: The “Value Trap” Identification

The Stellantis EV write-down highlights the danger of “Value Traps”—stocks that look cheap based on historical multiples but are actually fundamentally broken. With Stellantis trading at new 52-week lows, the P/E ratio may look enticing. However, without a clear path back to dividend payments and with a projected operating margin in the low single digits for 2026, the stock could remain “dead money” for several quarters.

(Internal link: related article about [how to spot value traps in a declining industry])

Stellantis vs. The “Mountain of EV Losses”

To truly grasp the magnitude of the Stellantis EV write-down, we must compare it to the broader industry. Stellantis is not an isolated case; it is the largest peak in a growing mountain of financial wreckage across the automotive sector.

A Comparative Look at Industry Impairments

In late 2025 and early 2026, several major players took similar, albeit smaller, hits. The following table illustrates how the Stellantis EV write-down compares to its peers:

| Manufacturer | Total Write-down Amount | Key Reason for Charge | 2026 Dividend Status |

| Stellantis | $26.5 Billion | EV Overestimation & Strategy Shift | Suspended |

| Ford Motor Co. | $19.5 Billion | Model Cancellations & Hybrid Pivot | Maintained (Reduced) |

| General Motors | $6.0 Billion | Contract Cancellations with Suppliers | Maintained |

| Volkswagen/Porsche | $6.0 Billion | Delay of Luxury EV Platforms | Maintained |

The Numeric Reality for Shareowners

Consider an investor who held $10,000 worth of Stellantis stock entering February 2026. Following the Stellantis EV write-down announcement, that position would have dropped to roughly $7,200 in a single trading session. Furthermore, the loss of the expected $0.77 per share dividend means the “yield” on that original investment has vanished. According to the International Energy Agency (IEA), while EV sales are still growing globally, the growth rate in North America and Europe has plateaued, creating a “lost decade” for manufacturers who over-leveraged their balance sheets on 100% electric futures.

When headlines regarding the Stellantis EV write-down dominate the news, it is easy to make emotional decisions. Avoid these common pitfalls:

- Panic Selling at the Absolute Bottom: While the outlook is grim, selling during a 25% one-day drop often locks in the maximum possible loss.

- Ignoring the “New Management” Effect: CEO Antonio Filosa is performing a “kitchen sink” quarter—throwing all the bad news out at once to start 2026 with a clean slate. This can sometimes lead to a sharp recovery once the dust settles.

- Underestimating Chinese Competition: The Stellantis EV write-down is partly due to the inability to compete with low-cost Chinese OEMs like BYD. If your automotive portfolio lacks exposure to the winners of this price war, you are only seeing half the picture.

- Over-reliance on Government Policy: Many investors bet on EVs because of subsidies. The Stellantis EV write-down proves that when policy shifts (as seen under the current U.S. administration), companies reliant on those “carrots” can fail overnight.

The Stellantis EV write-down of $26.5 billion is a watershed moment for the global economy. It signals the end of the “electrification at any cost” era and the beginning of a more pragmatic, demand-driven automotive landscape. For the individual investor, the key takeaway is that the automotive sector is undergoing a massive re-valuation. High-yield dividends that once felt safe are now being sacrificed to pay for the “botched” transition of the previous five years.

In summary, the Stellantis EV write-down teaches us:

- Accounting Matters: Massive write-downs are a trailing indicator of poor previous strategic decisions.

- Hybrids are the Bridge: The market is rewarding companies that offer “freedom of choice” rather than forced mandates.

- Liquidity is Safety: Stellantis’ 46-billion-euro liquidity buffer is the only thing standing between it and a major credit crisis.

Would you like me to analyze your current automotive holdings to see if they are at risk of a similar write-down? Understanding the “mountain of losses” is the first step toward building a more resilient, wealth-focused portfolio in 2026.