Winning a massive lottery prize is a dream for millions, but the reality of managing such a windfall requires a sophisticated Powerball jackpot financial strategy. As of late 2025, the Powerball jackpot has climbed to an incredible $1.7 billion, marking the fourth-largest prize in U.S. history. While the excitement of matching those six numbers is unparalleled, the financial complexity that follows can be overwhelming. Without a clear plan, many winners find themselves facing “the lottery curse”—losing their fortune within a few years due to poor management, legal battles, or predatory schemes.

Therefore, whether you are the lucky ticket holder or simply an investor looking to understand wealth preservation, having a structured approach to sudden wealth is essential. In this guide, we will break down how to handle hundreds of millions of dollars effectively, ensuring your windfall turns into a multigenerational legacy.

Core Concept: The Choice of a Lifetime

The foundation of any Powerball jackpot financial strategy begins with a single, irreversible decision: choosing between the lump-sum cash option and the 30-year annuity. This choice dictates your tax liability, your investment potential, and your long-term financial security.

Lump-Sum vs. Annuity: The Numbers

For a $1.7 billion jackpot, the cash value is typically around $735 million to $780 million before taxes. If you choose the lump sum, you receive all that money at once. However, if you choose the annuity, the $1.7 billion is paid out in 30 installments over 29 years, with each payment increasing by 5% to account for inflation.

The Time Value of Money

In the current economic environment of 2025 and 2026, interest rates remain a critical factor. Choosing the lump sum allows you to invest the capital immediately. If you can achieve a higher rate of return through a diversified portfolio than the lottery’s internal rate of return, the lump sum is mathematically superior. On the other hand, the annuity acts as a “forced discipline” mechanism, protecting the winner from spending the entire fortune in one go.

Practical Strategies: Building Your Wealth Infrastructure

Once you have decided on the payout structure, you must shift your focus toward protection. You should not attempt to manage a billion-dollar windfall alone. You need a specialized team of professionals who are experienced in ultra-high-net-worth (UHNW) management.

Assembling the “A-Team”

To execute a successful Powerball jackpot financial strategy, you should hire the following four experts immediately:

- Tax Attorney: To handle the immediate 24% federal withholding and the remaining 13% due at tax time, plus state-level obligations.

- Fiduciary Financial Advisor: Specifically, one who is a “fiduciary,” meaning they are legally obligated to act in your best interest.

- Estate Planning Lawyer: To set up trusts (like a Dynasty Trust) that protect your assets from lawsuits and ensure your heirs are provided for.

- Certified Public Accountant (CPA): To manage ongoing tax compliance and complex filings.

5 Actionable Steps for the First 90 Days

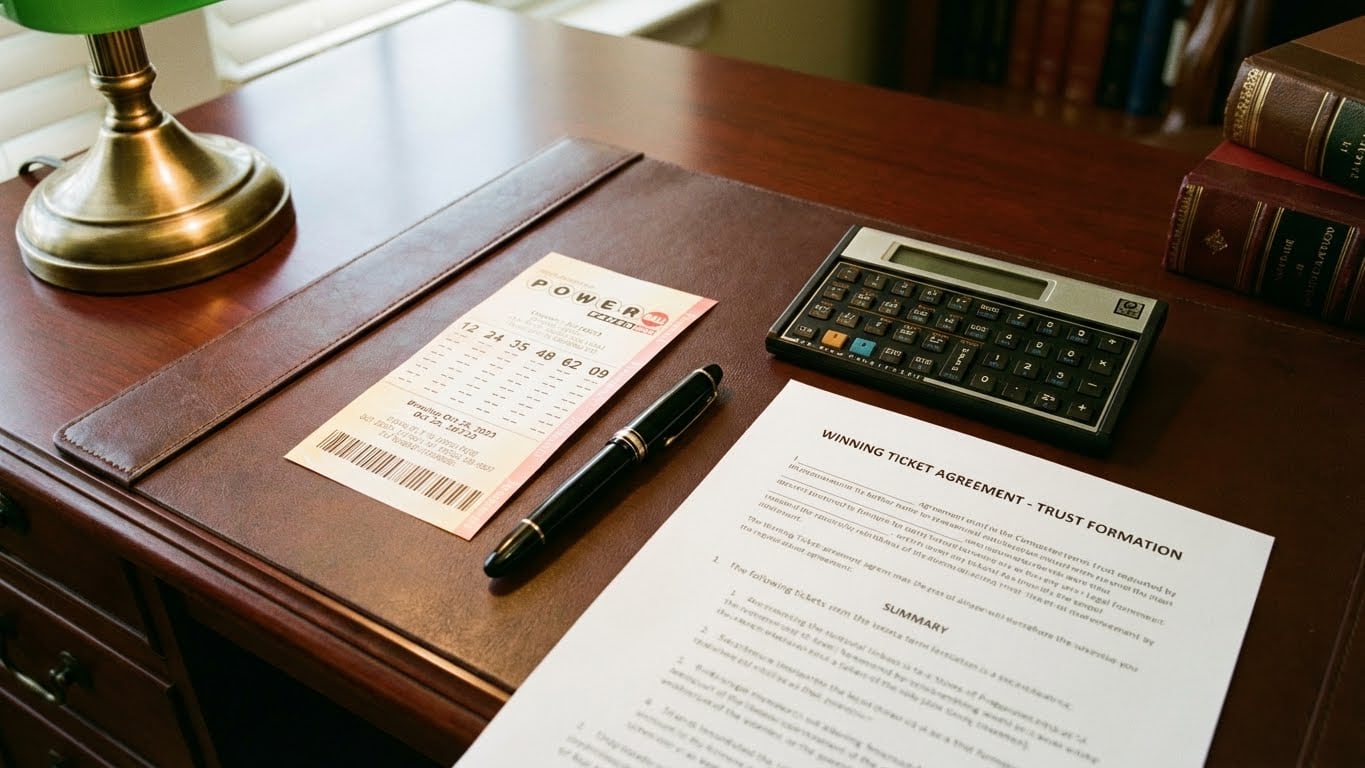

- Sign and Secure: Sign the back of your ticket (if allowed by state law) and place it in a high-security bank safe deposit box.

- Maintain Anonymity: If your state allows, claim the prize through a blind trust or an LLC to keep your name out of the headlines.

- The “No” Policy: Establish a policy where all requests for money are directed to your financial advisor. This removes the emotional pressure from you.

- Debt Elimination: Immediately clear all high-interest consumer debt to start your new life with a clean slate.

- The Cooling-Off Period: Avoid making any major purchases (houses, jets, yachts) for the first six months.

Portfolio Allocation and Risk Management

Managing a Powerball jackpot financial strategy isn’t just about spending; it’s about asset allocation. When you have hundreds of millions, your goal shifts from “getting rich” to “staying rich.”

| Asset Class | Suggested Allocation | Purpose |

| Fixed Income (Bonds) | 40% | Preservation of capital and tax-free income (Muni Bonds). |

| Equities (Stocks) | 40% | Long-term growth to outpace inflation. |

| Real Estate | 10% | Tangible assets and inflation hedge. |

| Alternatives/Cash | 10% | Liquidity and private equity opportunities. |

Case Insight: The “Endowment” Model

Consider treating your jackpot like a university endowment. By spending only 3% to 4% of the principal annually, a winner with a $500 million post-tax lump sum could live on $15 million to $20 million per year without ever touching the initial capital. This ensures that the Powerball jackpot financial strategy remains sustainable for decades.

According to the World Bank’s economic outlook, global market volatility and shifting interest rates mean that diversification is more important than ever. Relying on a single asset class is a recipe for disaster.

Common Mistakes and Risks to Avoid

- Publicity Overload: Announcing your win on social media. This attracts “long-lost” relatives, scammers, and frivolous lawsuits.

- Underestimating Taxes: Forgetting that the initial 24% withholding is rarely enough. You will likely owe an additional 13% to the IRS by the following April.

- DIY Management: Thinking you can manage $1.7 billion using a standard retail banking app.

- Lifestyle Creep: Increasing your annual expenses so rapidly that even a billion-dollar fortune cannot sustain the burn rate.

- The “Loan” Trap: Loaning money to friends and family without a legal contract. This often destroys relationships and your net worth simultaneously.

Conclusion – Key Takeaways & Next Steps

Executing a robust Powerball jackpot financial strategy is the difference between a lifetime of freedom and a cautionary tale. By choosing the right payout method, assembling a world-class team of advisors, and adhering to a disciplined investment plan, you can protect your windfall for generations.

The $1.7 billion Powerball jackpot represents a once-in-a-lifetime opportunity to build a legacy of philanthropy and security. However, remember that wealth is not just about what you win; it is about what you keep.

Must-Have Financial Tools & Tips for Smarter Investment Decisions

Ready to start your wealth-building journey? Whether you’ve won the lottery or are building your fortune through disciplined investing, the principles of wealth preservation remain the same. Explore our other guides on market insights to stay ahead of the curve!

One Comment