The global industrial landscape has entered a period of profound structural change, with one of its most critical pillars—the chemical sector—facing its most significant challenge in decades. As we navigate the early months of 2026, the phrase Chemieindustrie im Krisenmodus (chemical industry in crisis mode) has transitioned from a localized warning to a global macroeconomic reality. While the broader markets have shown resilience, the chemical industry remains trapped in a prolonged downcycle defined by chronic overcapacity, volatile energy costs, and a fundamental shift in global trade flows. For the strategic investor, understanding this “crisis mode” is essential, as it separates the legacy players facing obsolescence from the innovators poised to lead the next industrial supercycle.

Current data from the start of 2026 suggests that the sector is only just beginning to bottom out after three consecutive years of production contraction in regions like Europe. However, this crisis is not uniform. While basic petrochemicals are suffering under the weight of “inorganic” oversupply from Asia, specialty segments driven by green technology and AI-optimized manufacturing are carving out a new path for growth. In this guide, we will analyze the core drivers of the current crisis, provide a tactical framework for portfolio allocation, and explore why the Chemieindustrie im Krisenmodus might actually represent a generational “buy” signal for those who know where to look.

The Structural Anatomy of the 2026 Chemical Crisis

To understand why the Chemieindustrie im Krisenmodus is so persistent, we must move beyond simple cyclicality. The 2026 landscape is defined by a “Triple Squeeze”: rising input costs in the West, aggressive capacity expansion in the East, and a tightening regulatory environment that is rewriting the rules of profitability. Unlike previous downturns, this is a structural re-alignment of where and how chemicals are produced.

Global Overcapacity and the “China Factor”

The most visible pressure point in 2026 is the staggering oversupply of basic chemicals like ethylene, polyethylene, and propylene. Despite weak margins, investment in new plants has continued unabated, particularly in China. By mid-2026, China’s share of global production capacity in key basic chemicals is approaching 50%, a surge that has depressed utilization rates globally to below 75%. This chronic oversupply ensures that pricing power remains in the hands of the buyer, keeping margins for Western commodity producers at historic lows.

The Regional Energy Disparity

In the 2026 economic environment, “Energy is Fate.” The gap between low-cost regions (the US and Middle East) and high-cost regions (Europe) has widened into a chasm. European gas prices remain approximately 3.5 times higher than US Henry Hub prices, putting naphtha-based producers in regions like Germany and the Netherlands at a permanent cost disadvantage. This has led to the permanent closure of dozens of legacy plants, signaling a “de-industrialization” trend that is a core component of the Chemieindustrie im Krisenmodus narrative.

Practical Strategies: Investing During a “Crisis Mode”

Investing when a sector is in “crisis mode” requires a shift from volume-based growth to “margin-quality” growth. The Chemieindustrie im Krisenmodus environment rewards discipline and technological leadership over raw scale.

The Pivot to Specialty and High-Value Chemistry

The smartest capital in 2026 is rotating out of “Basic Chemicals” and into “Specialty Formulations.” These products—ranging from electronic chemicals for the semiconductor boom to high-performance additives for EV batteries—are less sensitive to raw material price fluctuations.

- Identify the “Moat”: Look for companies where R&D spending exceeds 5% of revenue. These firms are moving up the value chain where pricing power still exists.

- The “Green Premium”: Sustainable and bio-based feedstocks are no longer elective. As the Carbon Border Adjustment Mechanism (CBAM) fully takes effect in 2026, companies that have “de-carbonized” their supply chains are seeing a valuation premium.

AI-Enabled Operational Excellence

In an era of thin margins, the Chemieindustrie im Krisenmodus demands extreme efficiency. The leaders of 2026 are those using “Agentic AI” to optimize their plants.

- Predictive Maintenance: Reducing unplanned downtime by just 2% can add millions to the bottom line of a steam cracker.

- AI-Sourcing: Utilizing data-driven platforms to navigate volatile feedstock markets.

- Digital Twins: Simulating entire chemical processes to find the “sweet spot” for energy consumption and yield.

Actionable Steps for the 2026 Investor:

- Audit Your “Naphtha Exposure”: If your holdings are primarily European-based commodity players, be prepared for further “impairment charges” and dividend cuts.

- Track the “Cash Conversion Cycle”: In a downcycle, cash is king. Prioritize firms that have successfully reduced their SG&A and capital expenditures in 2025 to weather the 2026 storm.

- Monitor M&A Activity: The Chemieindustrie im Krisenmodus is triggering a wave of “distressed” consolidation. Strategic buyers with strong balance sheets are acquiring specialty assets at a discount.

Market Insights: Regional Winners and Losers

To visualize the impact of the Chemieindustrie im Krisenmodus, let’s examine the performance and utilization forecast of the major global chemical hubs as of early 2026.

Regional Competitiveness Matrix (2026 Forecast)

| Region | Primary Advantage | Primary Risk | 2026 Outlook |

| United States | Low-cost Ethane/Gas | Regulatory & Tariff Policy | Moderately Bullish |

| Middle East | Structural Feedstock Cost | Geopolitical Instability | Bullish (Specialties) |

| China | Massive Scale/Self-sufficiency | Chronic Overcapacity/Margins | Neutral (Volume-driven) |

| Europe (EU/UK) | High-Value Specialties | Structural Energy Crisis | Bearish (Commodities) |

Case Insight: The “Specialty Resilience” Scenario

Imagine an investor holding two positions: one in a German commodity plastics firm and another in a US-based electronic chemicals supplier.

- The Outcome: While the German firm faces a “margin squeeze” due to 1.2% rising labor costs and energy taxes, the US firm benefits from the massive domestic chip-manufacturing buildout.

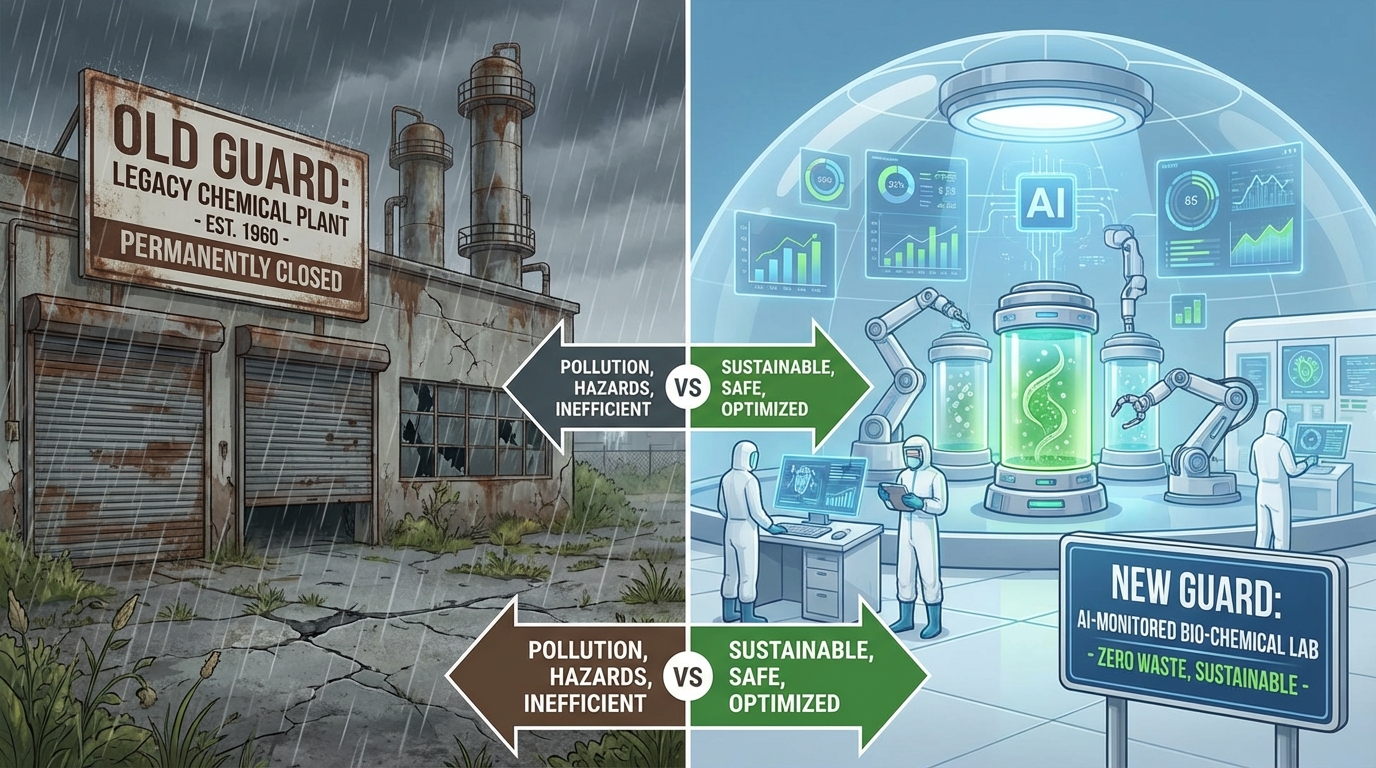

- The Takeaway: The phrase Chemieindustrie im Krisenmodus primarily applies to the “Old Guard.” The “New Guard” of chemistry is actually thriving by enabling the broader tech and energy transitions of 2026.

Economic Insight: According to theInternational Monetary Fund (IMF), industrial fragmentation and trade tensions are the primary inhibitors of a full manufacturing recovery. The chemical industry, as the “industry of industries,” is the most sensitive to these geopolitical “frictions.”

Common Mistakes and Risks to Avoid

- Chasing “Bargain” P/E Ratios: Many European chemical stocks look cheap on a P/E basis. However, if their energy costs are structurally higher, those earnings may never return to 2019 levels. This is a “value trap.”

- Underestimating “Carbon Tax” Impact: In 2026, the cost of emissions is a line item. shows that high-carbon producers are facing a rising “cost of capital.”

- Ignoring the “Tariff Wall”: The US and EU are increasingly using trade barriers to fight the influx of cheap Chinese chemicals. While this helps domestic prices, it can raise input costs for downstream manufacturers.

- Assuming a “V-Shaped” Recovery: The Chemieindustrie im Krisenmodus is a multi-year rebalancing act. Do not expect a return to “normalcy” until the excess global capacity is either absorbed or shuttered.

Conclusion – Key Takeaways & Next Steps

The Chemieindustrie im Krisenmodus is the final transition of the sector into the “Green and Digital” era. While the headline news remains dominated by plant closures in Germany and margin compression in basic plastics, the underlying story is one of radical transformation. By pivoting toward specialty chemicals, embracing AI-driven efficiency, and relocating to low-cost or high-growth regions, the “winners” of 2026 are already emerging from the wreckage of the downcycle.

Ultimately, wealth building in this sector requires the courage to be contrarian but the discipline to be selective. The crisis is real, but so is the opportunity for those who invest in the “Chemistry of Tomorrow.”

Are you ready to audit your industrial holdings?

Start by identifying which of your companies are still dependent on European naphtha versus those with “advantaged” feedstocks. Would you like me to create a “2026 Specialty Chemical Watchlist” to help you identify the firms most likely to lead the recovery in the second half of the year?