The dawn of 2026 has brought a stark reality for the technology sector, as the e-commerce giant officially confirmed a second massive wave of job cuts. On Wednesday, January 28, 2026, the news broke that Amazon laying off 16,000 additional corporate employees, bringing the total reduction to 30,000 since October. This decision is not merely a cost-cutting measure but a fundamental pivot in the company’s operating philosophy. According to internal memos, the objective is to “reduce layers, increase ownership, and remove bureaucracy” to regain the nimble spirit of a startup.

For investors, the Amazon laying off 16,000 staff announcement is a clear signal of structural re-alignment toward a leaner, AI-first future. While the human cost is significant, the financial markets have responded with optimism, viewing the move as a necessary step to improve operating leverage. As Amazon redirects billions toward generative AI and data center infrastructure, this “Project Dawn” initiative represents the largest workforce reduction in the company’s 31-year history. In this guide, we will analyze the core drivers of this restructuring and what it means for the future of the “everything store.”

The “World’s Largest Startup” Philosophy

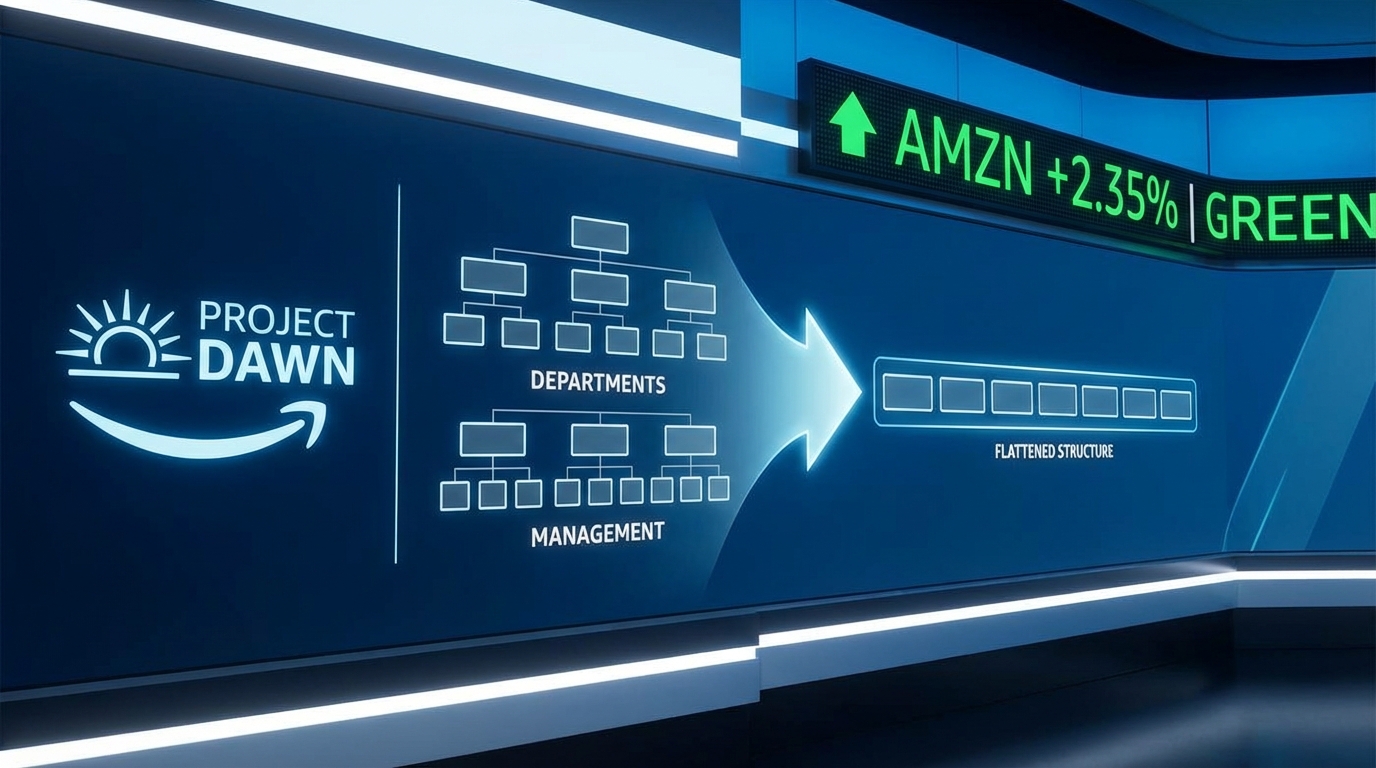

The core concept behind Amazon laying off 16,000 workers is a radical attempt to reverse the organizational bloat that occurred during the pandemic hiring spree. CEO Andy Jassy has been vocal about his desire for Amazon to operate like the “world’s largest startup.” In practice, this means flattening the organizational chart so that individual contributors have more direct impact and less administrative interference.

Reducing Management Layers and “Management Bloat”

A key component of this strategy is the systematic removal of middle-management layers. In the 2026 economic environment, speed of execution is the ultimate competitive advantage. By Amazon laying off 16,000 corporate roles—concentrated largely in AWS, Retail, and HR—the company is attempting to shorten the distance between a customer need and a product solution. Internal audits reportedly found that some decisions required as many as eight layers of approval, a “bureaucracy tax” that management is no longer willing to pay.

Project Dawn: The AI-First Capital Pivot

The internal name for this restructuring, “Project Dawn,” highlights a shift toward a new era of automation. Amazon is not just cutting jobs; it is reallocating capital. The company recently forecasted a staggering $125 billion in capital expenditures for 2026, the highest in the tech industry. Much of the savings from Amazon laying off 16,000 personnel will be funneled directly into Trainium and Inferentia chips, as well as massive data center campuses in Indiana and Mississippi.

Analyzing the Strategic Shift

When a company as large as Amazon cuts 10% of its corporate workforce, it creates a “re-rating” of its strategic value. For wealth builders and market analysts, the Amazon laying off 16,000 move provides a blueprint for how Big Tech will manage the transition from “growth at any cost” to “productivity-led growth.”

Monitoring Operating Leverage

Operating leverage occurs when a company’s revenue grows faster than its operating expenses.

- The Logic: By capping headcount growth while accelerating AI-driven automation, Amazon is attempting to widen its profit margins.

- The Result: Analysts are already raising their price targets, with many seeing a “Strong Buy” at the $246 level.

The Real Estate and Grocery Consolidation

The Amazon laying off 16,000 staff news was preceded by the closure of all remaining Amazon Fresh and Go grocery locations. This is a critical “Strategy Shift” to watch:

- Pivot to Whole Foods: Amazon is abandoning its homegrown “Just Walk Out” experiments to focus on the premium Whole Foods brand.

- Logistics Over Retail: The company is converting shuttered retail sites into micro-fulfillment centers.

- The Outcome: This reduces the “last-mile” delivery cost, which remains the most expensive part of the e-commerce chain.

Actionable Steps for Investors:

- Focus on AWS Re-acceleration: Watch for Q1 2026 earnings to see if the leaner AWS team can sustain its 20% growth rate.

- Audit Your Tech Concentration: Ensure you aren’t over-exposed to “Legacy Tech” that isn’t making similar efficiency pivots.

- Utilize Free Cash Flow (FCF) Analysis: According to the International Monetary Fund (IMF), “fiscal discipline in the private sector” is a leading indicator of regional economic resilience. Watch Amazon’s $FCF$ as it absorbs the $1.8 billion in severance costs.

Scenarios and Case Insights: The Math of the Cut

To understand the impact of Amazon laying off 16,000 employees, we must look at the financial “Monster Numbers” involved. While the headline number is large, the corporate workforce is only a fraction of the total 1.57 million employees.

Case Insight: The Severance and Support Package

Amazon is offering affected U.S. employees a 90-day internal job search period. If a new role is not found, they receive:

- A lump-sum severance payment (linked to years of service).

- Extended health insurance coverage.

- Outplacement services and career coaching.

Comparative Workforce Breakdown (Jan 2026)

| Workforce Category | Pre-Layoff Count | Post-Layoff (Estimated) | % Impacted |

| Total Global Workforce | 1.57 Million | 1.54 Million | ~1.9% |

| Corporate/Tech Roles | 350,000 | 320,000 | ~8.6% |

| Logistics/Warehouse | 1.22 Million | 1.22 Million | 0.0% |

As shown in the table, the Amazon laying off 16,000 staff event is a surgical strike on the “White Collar” segment of the business. By removing nearly 10% of its corporate headcount in three months, Amazon is betting that its internal AI “agents” can handle the reporting and project management tasks previously performed by thousands of middle managers. For the long-term investor, this is a bold experiment in “AI-Replacement” at scale.

“The 2026 economy is rewarding the ‘Lean Infrastructure’ model. We are seeing a historic shift where companies no longer measure power by the size of their staff, but by the efficiency of their silicon.” — World Bank Economic Outlook, 2026.

Common Mistakes and Risks to Avoid

- Panic Selling on the Headline: Don’t assume that Amazon laying off 16,000 people means the company is in trouble. Historically, tech stocks often rally on layoff news as the market prices in higher future profits.

- Underestimating the “Culture Shock”: The biggest risk is not financial, but cultural. Removing layers and increasing “ownership” can lead to burnout for the remaining staff.

- Ignoring the “Talent Drain”: When a company cuts deep, it often loses its most innovative “quiet” talent.

- Over-reliance on AI Projections: If the $125 billion AI investment doesn’t yield a significant revenue bump by 2027, the current layoffs will have been a “temporary fix” for a larger structural problem.

Conclusion – Key Takeaways & Next Steps

The news that Amazon laying off 16,000 corporate employees marks the end of an era and the beginning of “Project Dawn.” By reducing layers, increasing ownership, and removing bureaucracy, the company is attempting to reinvent itself as an agile, AI-first powerhouse. The $125 billion capital expenditure plan signals that Amazon is willing to sacrifice “headcount growth” for “technological dominance.” While the path to becoming the “world’s largest startup” will be volatile, the initial market reaction suggests that investors are ready for a leaner, more focused Amazon.

Ultimately, your goal as a wealth builder is to find companies that can adapt to the “Silicon Age.” Amazon’s pivot is a high-stakes bet that a leaner organization can innovate faster than a bloated one.

Are you ready to audit your portfolio for the “AI Shift”?

Start by identifying which of your holdings are still adding management layers versus those that are flattening their structures. Would you like me to create a “2026 Tech Efficiency Comparison” to help you see how Amazon’s headcount-to-revenue ratio compares to Meta and Microsoft?