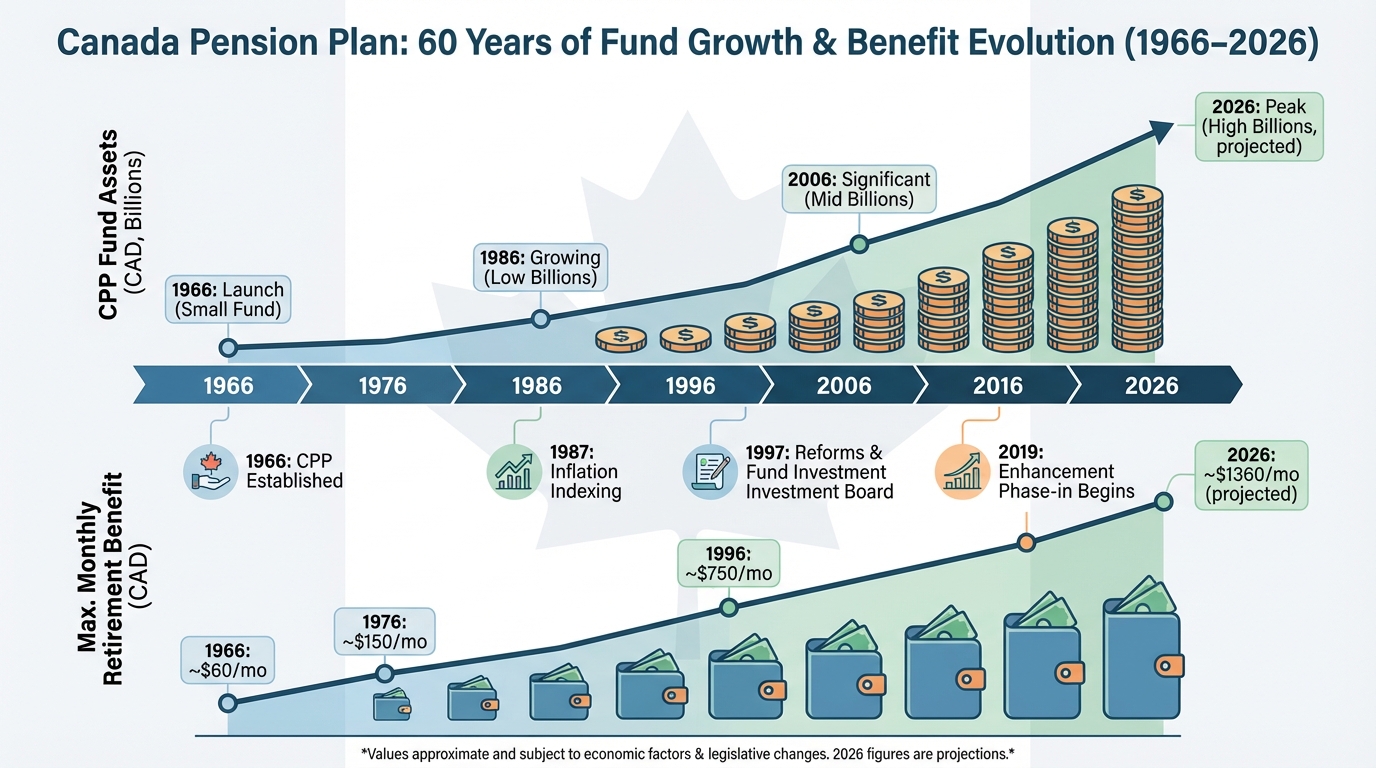

The year 2026 marks a historic milestone for the Great White North’s social safety net. January signifies the 60th anniversary of the Canada Pension Plan retirement pension, a fundamental pillar of financial security for millions of workers. When the plan was launched in 1966 under Prime Minister Lester B. Pearson, it was a bold experiment in intergenerational cooperation. Today, as the first “pension babies” reach their full retirement age, many are pausing to ask the hard questions: Is the Canada Pension Plan retirement pension actually a good deal? Has it truly paid off for those who have contributed their entire lives, or is it a relic of a bygone economic era?

Navigating personal finance in 2026 requires a clear-eyed look at how these foundational systems function. With the cost of living still a primary concern for many households, understanding the “return on investment” of your mandatory contributions is essential. Whether you are currently receiving benefits or are decades away from your first check, the evolution of the Canada Pension Plan retirement pension over the last six decades offers critical insights into wealth building and retirement sustainability in Canada.

The Evolution of Canada’s Retirement Foundation

The Canada Pension Plan retirement pension is a monthly, taxable benefit designed to replace a portion of your pre-retirement income. Unlike a private savings account, it is a “defined benefit” style plan, meaning your payout is determined by a formula based on how much and how long you contributed, rather than the fluctuating balance of a specific investment account.

How the Base and Enhanced CPP Components Work

Initially, the CPP was designed to replace only 25% of a worker’s average career earnings. This is now referred to as the “Base CPP.” However, recognizing that many Canadians were not saving enough privately, the federal government began a significant “Enhancement” phase in 2019. This multi-year transition, which continues to impact payrolls in 2026, aims to increase the income replacement level from 25% to 33.33%.

The enhancement introduced a second earnings ceiling, known as the Year’s Additional Maximum Pensionable Earnings (YAMPE). For 2026, the first ceiling (YMPE) is set at $74,600, while the second ceiling reaches up to $85,000. This “tiering” ensures that higher earners contribute more but also receive a significantly larger Canada Pension Plan retirement pension in the future.

Sustainability and the 75-Year Outlook

A common fear among younger contributors is the “zombie pension” myth—the idea that the money will run out before they retire. However, the most recent triennial report from the Office of the Chief Actuary of Canada, released in early 2026, reaffirms that the plan is fully sustainable for at least the next 75 years.

The reason for this resilience is the shift in 1997 toward an “independently managed” investment model. The CPP Investment Board (CPPIB) now manages a fund exceeding $770 billion. Unlike many other national pensions that rely purely on current workers to pay current retirees (a “pay-as-you-go” system), the Canada Pension Plan retirement pension is now heavily funded by investment returns. In fact, investment income is projected to account for nearly 40% of the plan’s revenue by 2030.

How to Maximize Your Benefits

Simply contributing to the Canada Pension Plan retirement pension is not a strategy; it is a requirement. True wealth building comes from knowing when and how to “activate” your benefits to fit your unique lifestyle and health expectations.

Choosing the Right Age to Start Your Pension

The standard age to begin receiving your pension is 65. However, you have the flexibility to start as early as 60 or as late as 70. This decision is one of the most impactful choices in Canadian personal finance.

- The Early Bird Penalty: If you start at age 60, your monthly payment is permanently reduced by 0.6% for every month before age 65 (a total reduction of 36%).

- The Late Bloomer Bonus: If you wait until age 70, your payment increases by 0.7% for every month after age 65 (a total increase of 42%).

In the current 2026 economic environment, where life expectancy continues to climb, many advisors suggest waiting. If you are in good health, the “guaranteed return” of waiting until 70 often outperforms what a conservative investment portfolio could provide.

Leveraging the CPP Enhancement

For those still in the workforce in 2026, you are paying into the “Enhanced” portion of the plan. This is essentially a forced high-yield investment.

- Strategy: If you are a high earner, be aware of the “CPP2” contributions on earnings between $74,600 and $85,000. While this reduces your take-home pay today, the long-term benefit is a much more robust Canada Pension Plan retirement pension that is fully indexed to inflation.

- Strategy: If you are self-employed, you must pay both the employer and employee portions. Ensure your business cash flow accounts for the 11.9% combined rate on base earnings and the 8.0% rate on the second tier.

Actionable Steps for Your 60th Anniversary Review:

- Check your Statement of Contributions: Log into your My Service Canada Account (MSCA) to see exactly what you have paid and what your estimated benefit looks like.

- Estimate your “Break-Even” Age: If you start at 60 versus 65, how long do you need to live to make the 65-start more profitable? (Usually, it is around age 74).

- Coordinate with OAS: Remember that the CPP is only one part of the puzzle. Ensure your Canada Pension Plan retirement pension start date aligns with your Old Age Security (OAS) strategy to minimize tax clawbacks.

Does the CPP Really Pay Off?

To see if the Canada Pension Plan retirement pension is a “good deal,” we have to look at the numbers. Let’s examine a hypothetical scenario for a worker retiring in 2026.

Scenario: The Full-Career Contributor

“David” has worked for 40 years, always earning the maximum pensionable amount.

- Total Contributions: Over 40 years, David and his employers contributed roughly $150,000 (adjusted for inflation).

- 2026 Benefit: David starts his pension at 65. He receives the maximum monthly amount of approximately $1,507.

- Annual Income: $18,084 per year, fully indexed to inflation.

If David lives to age 85, he will have collected over $360,000 in benefits. Even accounting for the “time value of money,” David has received more than double what he and his employer put in. When you factor in the “survivor benefits” and “disability benefits” that the plan provides as a form of insurance, the Canada Pension Plan retirement pension remains one of the most efficient ways to secure a floor for retirement income.

Economic Insight: According to theInternational Monetary Fund (IMF), the Canadian fiscal position remains among the strongest in the G7, partly due to the sustainable, arm’s-length management of the CPP fund.

Common Mistakes and Risks to Avoid

- Thinking the CPP is “Enough”: The maximum benefit in 2026 is still less than $20,000 per year. It is a foundation, not a complete plan Best Financial Planning Tools for Long-Term Growth.

- Ignoring the Taxman: Many retirees are surprised to find that their Canada Pension Plan retirement pension is fully taxable income. If you have a large RRIF or private pension, the CPP could push you into a higher tax bracket.

- Underestimating Longevity: Starting at 60 “just in case” is a common emotional mistake. Unless you have a shortened life expectancy, the 36% permanent cut is a high price to pay.

- Failing to Apply: The CPP is not automatic. You must apply for it at least six months before you want the payments to start.

Conclusion – Key Takeaways & Next Steps

As the Canada Pension Plan retirement pension turns 60, its value to Canadians is clearer than ever. While contribution rates have risen significantly since the 1.8% rate of 1966, the security and sustainability of the plan have also reached new heights. It has transformed from a simple “pay-as-you-go” system into a world-class investment fund that protects against market volatility and outlives its contributors.

For the modern worker in 2026, the CPP isn’t just a deduction on your paycheck; it is a guaranteed, inflation-protected annuity that will pay off for as long as you live. Has it really paid off? For the average Canadian who lacks a gold-plated private sector pension, the answer is a resounding yes.

Are you ready to optimize your retirement income? Your first step is to get an accurate estimate of your future payments. Would you like me to create a “Retirement Age Comparison Tool” to help you visualize exactly how much more you could earn by waiting until age 67 or 70?