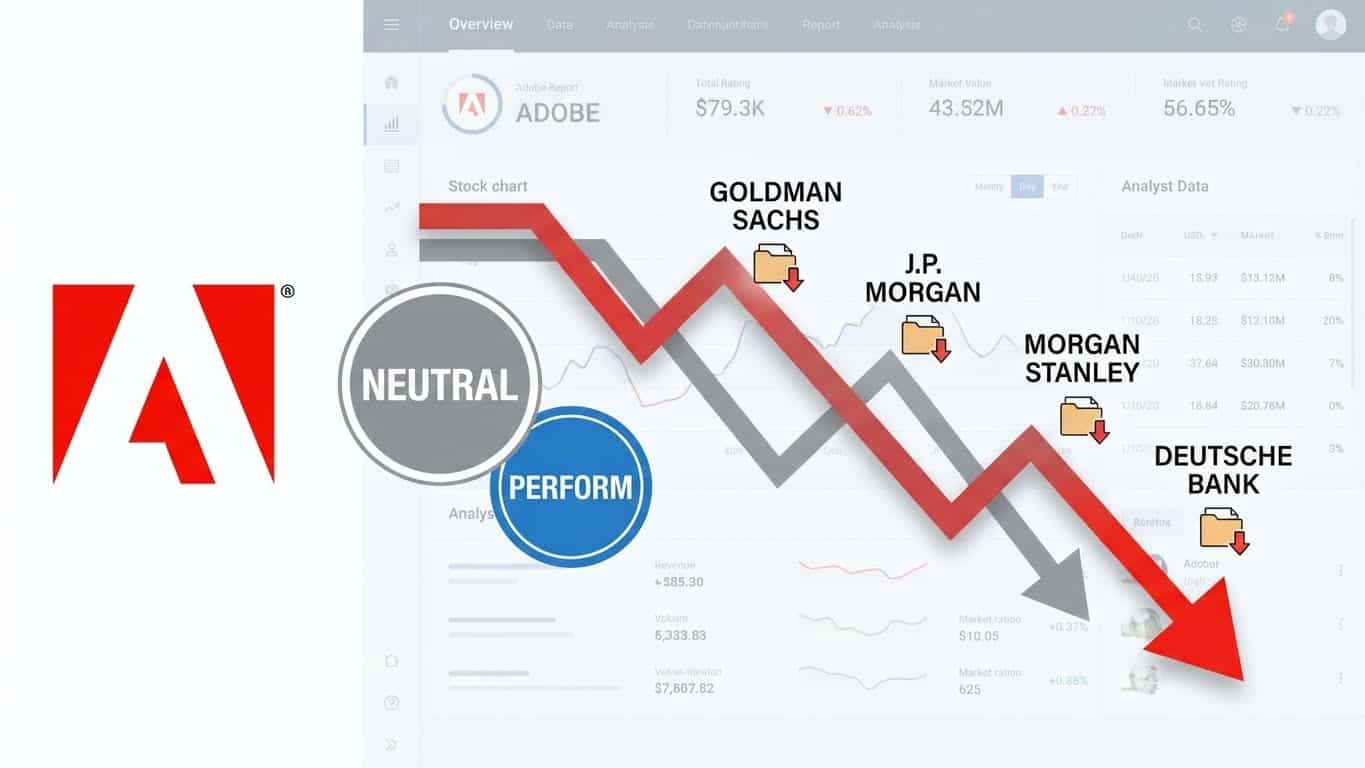

The software sector is undergoing a massive transformation in early 2026, and Adobe Inc. (NASDAQ: ADBE) is currently at the center of a significant shift in Wall Street sentiment. On January 13, 2026, the market reacted sharply as Oppenheimer downgrades Adobe to Perform, joining a growing list of financial institutions that have grown cautious about the creative giant’s near-term prospects. This “demotion” follows similar moves by Goldman Sachs, Jefferies, and BMO Capital, signaling a collective re-evaluation of how artificial intelligence (AI) will impact Adobe’s core business model.

For years, Adobe was the undisputed king of creative software. However, the current “AI technology transition” has introduced a level of competition and pricing pressure that few anticipated. While Adobe has successfully integrated its Firefly AI models across the Creative Cloud suite, analysts are increasingly worried that these innovations are not translating into the rapid revenue growth needed to sustain high valuations. As an investor, understanding the nuances of the Oppenheimer downgrades Adobe to Perform report is essential for navigating the volatility of the 2026 tech landscape.

Core Concept: The “AI Moat” Under Fire

The fundamental reason behind the recent wave of downgrades is a concern that AI might be shrinking Adobe’s competitive moat rather than expanding it. Historically, Adobe’s dominance was built on the steep learning curve of tools like Photoshop and Premiere Pro. Today, generative AI tools are lowering the barrier to entry, allowing prosumers and casual users to create high-quality content without the traditional “Adobe expertise.”

Decelerating Digital Media Growth

In the research note where Oppenheimer downgrades Adobe to Perform, analyst Brian Schwartz highlighted that the anticipated “AI-driven rebound” in the Digital Media segment has failed to materialize. Instead, growth has continued to decelerate throughout fiscal 2025 and into early 2026. This trend suggests that while users are adopting Adobe’s AI features, the company is struggling to monetize them effectively in a market flooded with low-cost or free AI alternatives from OpenAI, Canva, and even major platforms like Meta and Google.

Weakening Pricing Power

Another significant factor is the erosion of pricing leverage. As generative AI increases the speed of content creation, it also compresses the value of that creation. Analysts worry that Adobe may be forced to offer more features for the same subscription price—or even lower prices—to fend off nimble, AI-native rivals. This dynamic is a primary reason why operating margins for fiscal 2026 are projected to remain under pressure, even as the company remains highly profitable on a GAAP basis.

Practical Strategies: Navigating a “Hold” Sentiment

When a blue-chip stock like Adobe faces a series of downgrades, it often enters a “range-bound” period where the price fluctuates without a clear upward catalyst. To protect and grow your wealth in this environment, you need a disciplined framework that balances the long-term potential of the brand with the reality of near-term sentiment headwinds.

The “Valuation Floor” Assessment

Despite the downgrades, it is important to note that Oppenheimer downgrades Adobe to Perform rather than a “Sell” (though Goldman Sachs recently issued a Sell rating). This implies that at a certain price, Adobe becomes an attractive value play. As of early 2026, Adobe’s forward P/E multiple has dropped significantly compared to its five-year average.

- Action: Compare Adobe’s current P/E to its historical mean and the broader S&P 500. If the stock drops to a level where the earnings yield significantly exceeds the risk-free rate, it may represent a “generational buy” for patient investors.

Monitoring the “Net-New ARR” Metric

The most critical data point to watch in 2026 is Net-New Annual Recurring Revenue (ARR) for the Digital Media segment. This metric tells you if the company is successfully attracting new paying users or upselling existing ones to higher-tier AI plans.

- Step 1: Review the quarterly earnings reports (the next major call is scheduled for March 12, 2026).

- Step 2: Look specifically for “AI-influenced ARR.” Adobe management recently suggested this figure exceeds $8 billion, but the market wants to see this translate into higher total revenue growth, not just a shift in existing buckets.

- Step 3: Watch for the closure of the $1.9 billion Semrush acquisition, which could act as a small catalyst for the Digital Experience segment.

Actionable Steps for Retail Investors:

- Wait for a Base: Avoid “catching a falling knife” during the current wave of downgrades. Look for the stock to find a stable “base” on the technical chart.

- Diversify Tech Exposure: If your portfolio is heavy on application software (Adobe, Salesforce), consider balancing it with infrastructure plays (semiconductors, cloud providers) that are currently benefiting more directly from AI spend.

- Use Defensive Options: If you are a long-term holder, consider selling “covered calls” to generate income during this range-bound period.

How One Investor Turned $10,000 into $100,000 in Just 3 Years: A Success Story

Case Insights: Comparing the 2013 Pivot to 2026

To understand the current uncertainty, we can look back at Adobe’s 2013 transition from perpetual licenses to the Creative Cloud subscription model. That move was initially hated by the market, and the stock languished before embarking on a decade of 1,000%+ gains.

The 2013 vs. 2026 Comparison

| Metric | 2013 Cloud Pivot | 2026 AI Transition |

| Primary Challenge | Business Model (How people pay) | Core Functionality (How people create) |

| Competitive Threat | Low (Few professional rivals) | High (OpenAI, Canva, Figma, Apple) |

| Market Sentiment | High Skepticism | “Show Me” Mode |

| Long-Term Goal | Recurring Revenue Stability | AI Monetization & Efficiency |

In 2013, the barrier was financial; in 2026, the barrier is technological. The recent news that Oppenheimer downgrades Adobe to Perform suggests that Wall Street is not yet convinced Adobe can dictate the industry standard as easily as it did a decade ago. However, Adobe’s Return on Invested Capital (ROIC) remains near 53%, a staggering figure that indicates the company still has immense internal efficiency.

According to the Bank for International Settlements (BIS), the rapid deployment of AI is leading to a “re-rating” of established tech giants globally. Adobe is a prime example of this “wait-and-see” approach.

The New Food Pyramid 2026 USA: A Financial and Health Reset for Americans

Common Mistakes and Risks to Avoid

- Chasing “Cheap” Multiples: A stock that looks cheap compared to its history can still be expensive if its growth profile has fundamentally shifted downward.

- Ignoring the “Apple Factor”: Apple’s recent launch of its own “Creator Studio” subscription for $12.99/month is a direct threat to Adobe’s prosumer base.

- Overestimating AI Hype: Just because a company has AI features doesn’t mean it has an AI business. Ensure the AI is driving incremental revenue, not just retaining existing users.

- Neglecting Regulatory Risks: Adobe is currently facing a significant FTC lawsuit regarding its subscription cancellation practices, which could impact its “dark pattern” revenue and overall sentiment.

- Macro Sensitivity: As interest rates remain volatile in 2026, enterprise IT spending may slow down, making it harder for Adobe to hit its 10% revenue growth targets.

Conclusion – Key Takeaways & Next Steps

The fact that Oppenheimer downgrades Adobe to Perform is a clear signal that the “easy money” in the creative software sector has been made for now. While Adobe remains a financial powerhouse with world-class margins and a massive user base, it is currently navigating a “perfect storm” of intensifying AI competition, regulatory scrutiny, and decelerating growth.

For the disciplined investor, the key is to look for signs of a turnaround in the Digital Media segment. Until Adobe can prove that its Firefly AI models are driving meaningful, top-line growth, the stock is likely to remain in a “penalty box.” Use this time to observe the competitive landscape and evaluate whether the current discount in valuation justifies the long-term risk of a shrinking creative moat.

Would you like me to help you analyze Adobe’s latest Cash Flow Statement to see if their massive share buybacks are effectively offsetting the recent stock decline? Stay informed and keep your portfolio resilient by exploring our other guides on the AI-driven tech shift.

One Comment