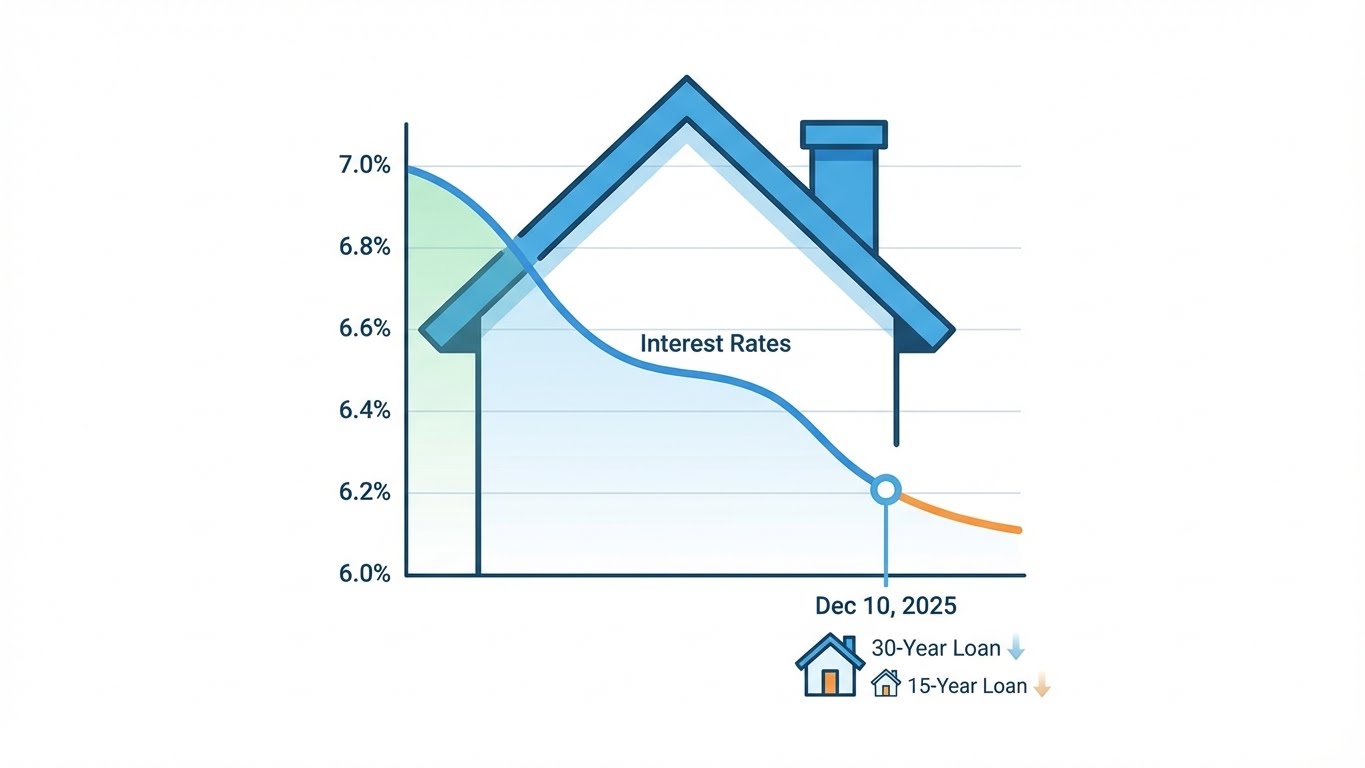

If you’re trying to make sense of todays mortgage interest rates December 10 2025, you’re not alone. After years of volatile borrowing costs, mortgage rates in late 2025 have pulled back from their peaks, but they’re still high enough to make every percentage point matter for your monthly payment and long-term wealth.

In this guide, you’ll see where rates actually are today, why different sources quote different numbers, and—most importantly—how to decide whether to lock, refinance, or wait.

Understanding Today’s Mortgage Interest Rates December 10 2025

On December 10, 2025, national data sources show U.S. mortgage rates clustered in a fairly tight range, but not at exactly the same number. That’s because each survey looks at different lenders, points, and borrower profiles.

Broadly, for a well-qualified borrower (strong credit, solid income, standard down payment), you can expect:

- 30-year fixed-rate mortgage: around 6.2%–6.3%

- 15-year fixed-rate mortgage: around 5.5%–5.8%

- Adjustable-rate mortgages (ARMs): generally in the mid-6% range

For example:

- Mortgage News Daily’s daily survey lists an average 30-year fixed rate near 6.30% and a 15-year fixed around 5.80% for top-tier borrowers as of December 10, 2025. mortgagenewsdaily.com+1

- Freddie Mac’s weekly Primary Mortgage Market Survey, updated through December 4, 2025, shows 6.19% for a 30-year fixed and 5.44% for a 15-year fixed. freddiemac.com+2myhome.freddiemac.com+2

- A Yahoo Finance roundup for December 10, 2025 reports a 30-year fixed at about 6.22%, a 20-year fixed near 6.18%, and 15-year fixed around 5.68%, plus ARMs in the high-6s. Yahoo Finance

- Zillow’s rate tracker shows 30-year fixed rates around 6.0%–6.125% and 15-year fixed near 5.5% on the same date. Zillow

In other words, todays mortgage interest rates December 10 2025 are hovering a little above 6% for a standard 30-year loan—still elevated by historical standards, but meaningfully lower than the 7–8% levels seen in prior years.

For official weekly averages, you can review the latest Freddie Mac Primary Mortgage Market Survey. freddiemac.com+1

How the Numbers Are Calculated

National rate averages are:

- Survey-based: Collected from a sample of lenders across the country.

- Assumption-heavy: They typically assume a certain loan amount, points paid, and borrower credit profile.

- Not a quote: The average is not the rate you’re guaranteed; it’s a reference point.

That’s why your own offers may be higher or lower than today’s mortgage interest rates December 10 2025 you see in the news.

Your personal rate depends on:

- Credit score and credit history

- Debt-to-income (DTI) ratio

- Down payment and loan-to-value (LTV)

- Property type (primary home vs. investment property)

- Loan size (conforming vs. jumbo)

- Points and closing costs

How Today’s Mortgage Interest Rates December 10 2025 Compare With Recent Years

Compared with late 2023–2024, when many borrowers saw 30-year fixed rates well over 7%, current levels are meaningfully lower. Freddie Mac data shows the average 30-year rate down from prior highs and sitting near the lower end of its 52-week range, around the low-6s as of early December 2025. freddiemac.com+2mortgagenewsdaily.com+2

At the same time, mortgage rates have not collapsed. Even after the Federal Reserve’s third rate cut of 2025, 30-year fixed loans are stabilizing near yearly lows around 6.3%, not dropping back to the 3–4% range of the pre-inflation era. Reuters

So you’re operating in a “moderately high but improving” rate environment—not cheap money, but not the peak stress levels either.

Section 2 – Practical Strategies / Framework

Now that you know where today’s mortgage interest rates December 10 2025 stand, the key question is: what should you do about it?

Strategy 1 – Decide Whether to Lock, Float, or Refinance

1. If you’re about to buy a home

Ask yourself:

- Timeline: Are you closing within 30–60 days?

- Budget: Does your monthly payment still fit comfortably at today’s rate?

- Risk tolerance: Can you handle a surprise increase?

General framework:

- If current quotes align with your budget and the home is right, locking a competitive rate near today’s averages can be prudent.

- If you’re very rate-sensitive and have a bit of time before closing, you might float for a short period while watching economic data and Fed commentary—but set a clear “lock no later than” date to avoid gambling.

2. If you already have a mortgage

Refinancing into today’s mortgage interest rates December 10 2025 makes sense when:

- Your existing rate is at least 0.75–1.00 percentage point higher than what you can get now.

- You plan to stay in the home long enough to break even on closing costs.

- You’re not extending your term so much that you wipe out all interest savings.

Check:

- Current rate vs. new rate

- Estimated closing costs

- Break-even timeframe (closing costs ÷ monthly savings)

Higher for Longer Interest Rates: 5 Big Shifts Investors Must Understand in 2026

Strategy 2 – Choose the Right Loan Term and Structure

Even on the same day, you’ll see very different offers for different products:

- 30-year fixed

- 15-year fixed

- Jumbo vs. conforming

- Government-backed (FHA, VA) vs. conventional

- ARMs (e.g., 5/6, 7/6 SOFR)

Loan types behind today’s mortgage interest rates December 10 2025:

- 30-year fixed:

- Highest rate, lowest monthly payment

- Best for long-term stability and tight monthly cash flow

- 15-year fixed:

- Lower rate, much higher monthly payment

- Best for people prioritizing rapid equity build and interest savings

- ARMs:

- Often start with a slightly lower initial rate than a 30-year fixed

- Rate adjusts after the initial fixed period; more complex and risky if you might still own the home later

Actionable steps to compare options

- Get at least 3 quotes from different lenders on the same day for:

- 30-year fixed

- 15-year fixed

- An ARM (if you’re open to it)

- Ask each lender to show:

- Interest rate

- APR

- Points & fees

- Monthly payment

- Run your own comparison:

- How does the monthly payment change?

- How much total interest will you pay over the life of the loan?

- How realistic is the higher payment on a shorter term?

- Align the loan with your goals:

- Maximize flexibility? Lean toward a 30-year fixed.

- Crush debt faster and can handle higher payments? Consider a 15-year.

- Expect to move or refinance within a set period and can manage risk? Evaluate ARMs carefully.

Section 3 – Examples, Scenarios, or Case Insights

To see how today’s mortgage interest rates December 10 2025 impact real numbers, let’s look at simple scenarios. These are approximate and for illustration only.

Example 1 – 30-Year vs. 15-Year at Today’s Rates

Assume:

- Loan amount: $400,000

- 30-year fixed rate: 6.3% (roughly in line with daily national averages) mortgagenewsdaily.com+1

- 15-year fixed rate: 5.5% (within the 5.4–5.8% range) freddiemac.com+2myhome.freddiemac.com+2

Approximate monthly principal & interest payments:

| Loan Type | Rate | Term | Monthly Payment | Total Interest Paid Over Life |

|---|---|---|---|---|

| 30-Year Fixed | 6.3% | 30 yrs | ≈ $2,475 | ≈ $491,000 |

| 15-Year Fixed | 5.5% | 15 yrs | ≈ $3,300 | ≈ $188,000 |

What this tells you:

- The 15-year payment is ~$825 higher per month, but

- You save over $300,000 in interest across the life of the loan.

If your cash flow can handle it comfortably—even in a job loss, emergency, or higher-expense year—a shorter term can be a powerful wealth-building tool.

Example 2 – Effect of a 0.5% Rate Change

Using the same $400,000 loan:

- At 6.8%, a 30-year fixed payment is roughly $2,600 per month.

- At 6.3% (closer to today’s mortgage interest rates December 10 2025), the payment drops to around $2,475 per month.

That ~0.5% reduction:

- Saves about $125 per month, or $1,500 per year.

- Over 10 years, that’s roughly $15,000 in cash flow difference before considering interest compounding.

This is why shopping for the best possible rate today is not just a detail—it’s a long-term cash-flow strategy.

Example 3 – Buyer vs. Renter Decision in 2025–2026

In the current environment of:

- Moderating but still elevated inflation

- Mortgage rates around the low-6% range for 30-year loans

- Home prices that have cooled in some markets but remain high in others

The buy-vs-rent decision comes down to:

- Time horizon: Plan to stay at least 5–7 years? Buying becomes more compelling.

- Stability: Reliable income and emergency savings to handle maintenance and surprise costs.

- Alternative returns: Could your down payment earn a better risk-adjusted return elsewhere?

Use today’s mortgage interest rates December 10 2025 as a concrete input into that calculus, not the sole deciding factor.

Common Mistakes and Risks

Before you rush to lock or refinance, avoid these common pitfalls:

- Only looking at the headline rate

- Always compare APR, fees, and points, not just the advertised rate.

- Ignoring credit score optimization

- A small boost in your score can push you into a better pricing tier and lower your rate.

- Stretching your budget to the limit

- Don’t base affordability on best-case income; stress test your budget for setbacks.

- Choosing an ARM without understanding adjustments

- Know when and how often the rate can change, and what the caps are.

- Mis-timing a refinance

- Refinancing from 7.5% to something near today’s mortgage interest rates December 10 2025 might be smart—but only if you’ll stay long enough to recoup closing costs.

- Failing to get multiple quotes on the same day

- Lenders’ rate sheets move quickly; an apples-to-apples comparison requires quotes under similar market conditions.

- Assuming rates will definitely fall further

- Market expectations can shift fast. Build a plan around what you can lock now, not hopes of the perfect future rate.

Conclusion – Key Takeaways & Next Steps

When you step back and look at today’s mortgage interest rates December 10 2025, a clear picture emerges:

- 30-year fixed rates are hovering just above 6%, down from the peaks but still high enough to impact affordability. Zillow+3mortgagenewsdaily.com+3mortgagenewsdaily.com+3

- 15-year fixed rates are lower, in the mid-5% range, offering major long-term interest savings in exchange for a higher monthly payment. freddiemac.com+2mortgagenewsdaily.com+2

- The current environment, shaped by cooling inflation and recent Fed rate cuts, is more favorable than 2023–2024, but still requires careful planning. Reuters+1

Your next steps:

- Pull your credit reports and scores so you know where you stand.

- Get multiple same-day quotes from at least three lenders.

- Use a mortgage calculator to compare 30-year vs. 15-year vs. ARM options.

- Run your refinance break-even or buy-vs-rent analysis with today’s numbers.

- Choose a strategy that supports your long-term wealth plan, not just this month’s payment.

If you’re serious about using mortgages as a tool for financial independence, continue with deeper reading on your next click:

The rates you see today are just one snapshot in time. The real power comes from how you respond—intentionally, strategically, and with a clear plan.